Private Equity-Owned Prospect Medical Holdings is in Precarious Financial Situation, According to Independent Financial Review

April 20, 2021

An independent analysis of financial disclosures by the embattled safety net hospital chain Prospect Medical Holdings reveals that the chain is in a precarious financial position.

Prospect Medical Holdings has been majority-owned by private equity firm Leonard Green & Partners since 2010. Leonard Green is now trying to exit its stake in Prospect after siphoning hundreds of millions of dollars out of it in dividends and fees, leaving the hospital chain in dire straits.[1]

See ProPublica (2/4/21): Rich Investors Stripped Millions From a Hospital Chain and Want to Leave It Behind. A Tiny State Stands in Their Way.

Leonard Green’s proposed exit from Prospect requires approval from regulatory agencies in Rhode Island, where Prospect owns two hospitals. In their review process for the transaction, the Rhode Island Department of Health and Office of the Attorney General hired accounting firm PYA to analyze Prospect’s financial statements. PYA’s initial findings, released on April 6, 2020 and summarized below, indicate that Prospect faces pronounced financial viability risks.

When stakeholders, regulators, and lawmakers across the country have raised concerns about Leonard Green’s ownership of Prospect, the company has dismissed these concerns with claims that the company is “well-capitalized” with sufficient resources to respond to the pandemic.[2] PYA’s presentation demonstrates Prospect’s financial condition is worse than previously represented.

See PYA’s full presentation here.

Key takeaways from PYA’s initial analysis of Prospect Medical Holdings:

PYA writes: “Both PCC [Prospect CharterCARE] and PMH face long term financial viability risks”[3]

This contradicts Leonard Green’s and Prospect’s claims about the company’s financial condition.

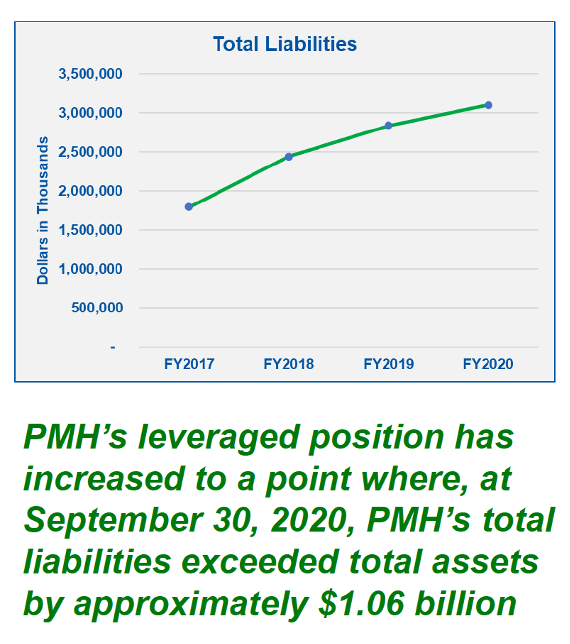

“PMH’s leveraged position has increased to a point where, at September 30, 2020, PMH’s total liabilities exceeded total assets by approximately $1.06 billion“[4]

This contradicts Leonard Green’s and Prospect’s repeated claims that the company is well-capitalized.

“Consideration to Sellers:

‒$11.9 million payment for approximately 66% of stock

‒ Release from any portion of approximately $3.1 billion in liabilities”[5]

According to PYA, part of what Leonard Green will receive from this transaction is a release from any portion of the $3.1 billion in liabilities that Prospect holds. This means that Leonard Green is let off the hook after siphoning hundreds of millions of dollars from Prospect, adding substantial debt, and leaving the hospitals in deteriorating financial condition.

“No evidence provided of additional capital contributed by GEI since original investments (except capital contributions returned via dividends in 2019).”[6]

This means that besides Leonard Green’s initial investment to acquire Prospect in 2010, the company has not put any additional capital into Prospect.

“$387 million in PMH cash at September 30, 2020 includes approximately $276 million associated with Medicare Advanced and Accelerated Payments (MAAP), which repayment is required over a period of up to 17 months”[7]

While Prospect has more cash on hand than it did in FY 2019, the vast majority of it (71%) is COVID stimulus loans Prospect will have to pay back. Prospect has also received at least $187 million in grants through the CARES Act.[8]

[1]https://pestakeholder.org/wp-content/uploads/2020/05/UPDATE-Leonard-Green-Prospect-Medical-Dividends-PESP-051420.pdf

[2]https://pestakeholder.org/members-of-congress-slam-leonard-green-partners-response-on-safety-net-hospital-company-prospect-medical-holdings-calling-its-actions-unacceptable-and-dishonest/

[3] PYA presentation, pg. 20.

[4] PYA presentation, pg. 16.

[5] PYA presentation, pg. 7.

[6] PYA presentation, pg. 18.

[7] PYA presentation, pg. 17.

[8] Covid Stimulus Watch, Good Jobs First tracker. https://data.covidstimuluswatch.org/prog.php. Accessed April 6, 2021.