Why Did US Pensioners Pay for Platinum Equity’s Fundraising from Foreign Investors?

April 6, 2022

In July 2019, private equity firm Platinum Equity reported using two placement agents, VolcomCapital SA and Magenta Capital Services Ltd., to raise capital from non-US investors for Platinum Equity Capital Partners V.[i]

VolcomCapital was founded by Sebastián Piñera Morel, son of Chilean President Sebastián Piñera.[ii]

Magenta Capital Services Ltd, which is registered in the British Virgin Islands, is run by Mohammed Afkhami and raises capital in the Gulf Region, Brunei and Malaysia.[iii]

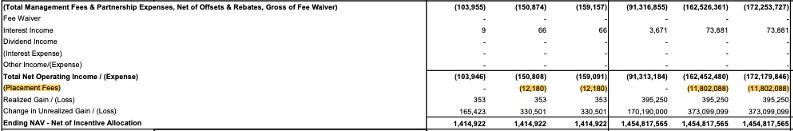

In a 2020 fee report to the Fresno County (CA) Employees Retirement System, Platinum Equity reported charging the pension fund a pro-rata share ($12,180) of the $11.8 million in placement fees paid to help raise Platinum Equity Capital Partners V.

Based on average placement fees of 2-2.5% of capital raised[iv], the placement agents likely raised $470 million to $590 million for Platinum Equity Capital Partners V.

Platinum Equity Capital Partners V was oversubscribed. Platinum Equity initially targeted $8 billion for the fund but ultimately raised $10 billion, suggesting the placement agents were not integral to the fundraise.[v]

Given that the fundraising by VolcomCapital and Magenta Capital Services was exclusively focused on non-US investors, why were their fees charged to US pensioners?

Some of Platinum Equity’s largest investors bar placement agents.

In April 2019, Pennsylvania PSERS reported that no placement agent was used in connection with Platinum Equity Capital Partners V.[vi]

The New York City pension funds banned placement agents in 2014.[vii]

Last October, Bloomberg reported that Platinum Equity is now seeking to raise a new, even larger fund, Platinum Equity Capital Partners VI, seeking $15 billion.[viii] For the new fund, Platinum Equity has turned once again to at least one of the same placement agents, Chile-based VolcomCapital SA.

Will US pensioners again pay the cost of Platinum Equity’s fundraising from non-US investors?

[i] Platinum Equity Capital Partners V Form D, Jul 15, 2019, https://www.sec.gov/Archives/edgar/data/0001778958/000177895819000001/xslFormDX01/primary_doc.xml.

[ii] “El meteórico ascenso de Volcom en la opaca y millonaria industria de distribución de fondos,” El Mostrador, Aug 25, 2017. https://www.elmostrador.cl/mercados/2017/08/25/el-meteorico-ascenso-de-volcom-en-la-opaca-y-millonaria-industria-de-distribucion-de-fondos/

[iii]https://lslpartners.co.uk/mohammed-afkhami, accessed Mar 9, 2022.

[iv] “How Do Private Equity Placement Agents Get Paid?” Houston Chronicle, Dec 17, 2021 https://work.chron.com/private-equity-placement-agents-paid-29012.html.

[v] Platinum Equity Capital Partners V Form D, Jul 15, 2019, https://www.sec.gov/Archives/edgar/data/0001778958/000177895819000001/xslFormDX01/primary_doc.xml. Platinum Equity Capital Partners V Form D/A, Jan 8, 2020, https://www.sec.gov/Archives/edgar/data/0001778958/000177895820000001/xslFormDX01/primary_doc.xml.

[vi] Public Investment Memorandum, Platinum Equity Capital Partners V, L.P., Apr 29, 2019, .

[vii] “New York City Pension Funds Enact Placement Agent Ban,” Media release, Jun 9, 2014 https://comptroller.nyc.gov/Newsroom/New-York-City-Pension-Funds-Enact-Placement-Agent-Ban/.

[viii] “Platinum Equity Eyes $15 Billion Buyout Fund, First-Ever Credit Vehicle,” Bloomberg, Oct 26, 2021, https://www.bloomberg.com/news/articles/2021-10-26/platinum-eyes-15-billion-buyout-fund-first-ever-credit-vehicle.