Texas bankruptcy court approves Envision Healthcare’s split into two companies with new owners

October 26, 2023

Medical staffing firm Envision Healthcare is close to exiting bankruptcy after the U.S. Bankruptcy Court for the Southern District of Texas, Houston Division, signed off on the company’s plans of reorganization on October 11.[1] The reorganization splits Envision into Envision Physician Services (EVPS) and AMSURG, which will have separate leadership and owners. Private equity firm KKR will no longer retain ownership of either company, and $7 billion in debt will be trimmed off the two companies’ balance sheets.[2]

Reuters reported that, “After the restructuring, AMSURG will have $1.875 billion in debt and approximately $1.675 billion in equity value, according to bankruptcy court filings. EVPS will have $250 million in debt and approximately $550 million in equity value.”[3]

KKR acquired Envision in a $9.9 billion leveraged buyout in 2018,[4] which was one of the largest buyouts since the financial crisis.[5] The deal was financed with $7 billion in debt—about 70.7% of the overall deal.[6] This unwieldy amount of debt, and the bipartisan No Surprises Act that put the nail in the coffin of Envision’s surprise billing business strategy, set Envision on a path of financial distress.[7]

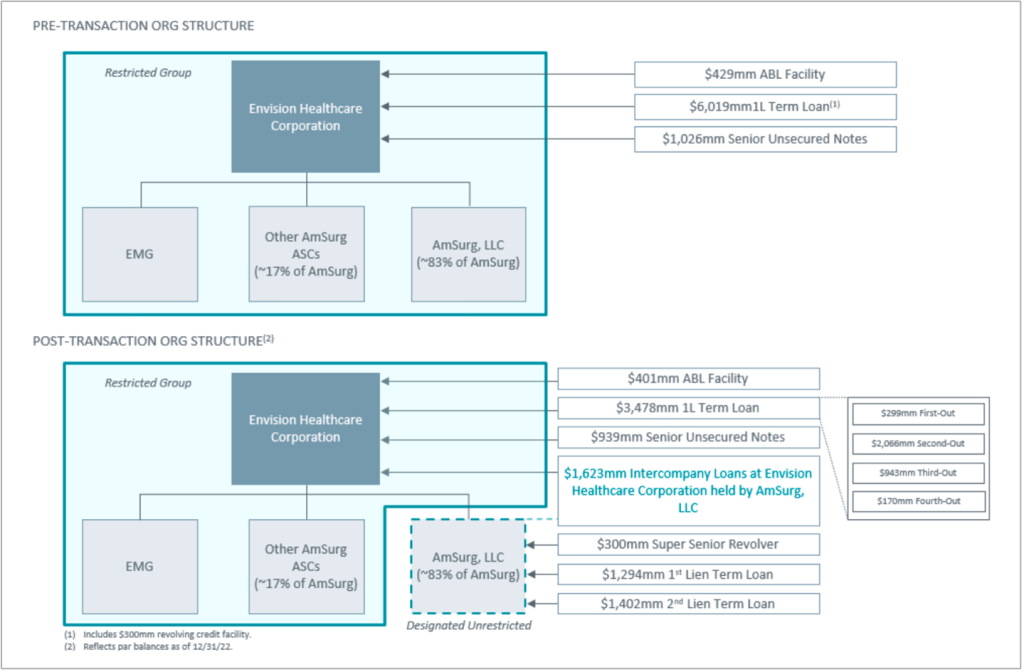

Envision’s bankruptcy was the culmination of credit downgrades and distressed debt exchanges beginning in 2020, in which KKR and Envision, with the help of high-powered law firms, nimbly shielded their most valuable assets from some of their original creditors,[8] as predicted by researchers Eileen Appelbaum and Rosemary Batt.[9] Figure 1, taken straight from Envision’s bankruptcy documents, shows how the profitable AMSURG was cordoned off from the rest of Envision.

Figure 1:Envision’s org structure before and after its “2022 liability management transactions.”[10]

Reuters reports that separate lending groups that provided loans to Envision prior to its bankruptcy will assume ownership of the companies. Private equity firm Blackstone, which served as a private credit lender for Envision and owns Envision’s competitor TeamHealth, and investment group Brigade Capital will be some of AMSURG’s new owners.[11] Pacific Investment Management, Co., which was also one of Envision’s creditors, will be AMSURG’s new majority owner.[12]

The No Surprises Act blame game

Envision’s business model has historically relied on the inelastic demand of emergency medical care coupled with a strategy of out-of-network billing to charge much higher than average rates to patients via surprise bills.[13] This business model was deeply impacted by the passage of the No Surprises Act in December 2020, which banned most forms of surprise billing.[14]

The No Surprises Act went into effect in January of 2022.[15] In March 2022, researchers Eileen Appelbaum and Rosemary Batt declared that Envision Healthcare had “hit the skids,” arguing that Envision would have to pivot back to a surprise billing strategy, “if it was to meet its debt obligations.”[16] Yet, this was not a possibility given that the No Surprises Act was now in effect.[17]

In its May 2023 bankruptcy filing, Envision claimed that the “flawed” implementation of the No Surprises Act had contributed to its need to file for bankruptcy. The company placed blame on insurers, rather the Act itself, writing, “In fact, some payors (including Envision’s single largest payor) have used the No Surprises Act and its implementing regulations as an excuse to avoid payment to medical groups like Envision and affiliated entities.”[18] Pinning the blame on insurers, rather than the No Surprises Act, obscures the fact that Envision spent millions on a dark money campaign against surprise billing legislation.[19]

Leadership changes

Despite a bankruptcy under his belt, Envision CEO Jim Rechtin will be moving on to another high-profile role in the very industry that Envision blamed for some of its financial woes. On October 11, multiple news outlets announced that that Envision’s CEO Jim Rechtin would be leaving his position to take on the role of president and COO at insurance giant, Humana.[20][21][22]

Prior to joining Envision in 2020, Rechtin was the CEO of Optum, a subsidiary of insurer UnitedHealth Group[23] and one of Envision’s competitors.[24] Optum’s parent company, UnitedHealth Group has been embroiled in multiple lawsuits with Envision in an ongoing feud over surprise billing that predates KKR’s acquisition of Envision,[25] but intensified in 2022.[26] The feuding resulted in UnitedHealth terminating its in-network contract with Envision, which credit rating agency Moody’s named as a factor contributing to Envision’s worsening financial situation in September 2022.[27]

Rechtin has also held senior roles at DaVita Medical Group, as well as spent 14 years working at consulting firm Bain & Co, according to Bloomberg.[28]

Bankruptcy impacts

As Envision’s financial condition worsened before the bankruptcy filing, it announced layoffs of 167 New York employees in March, 90 Florida employees in April,[29] and another 162 workers in Pennsylvania in May.[30] It is unclear to what extent patients and workers may have been impacted by Envision’s bankruptcy since the filing, although the company claimed at the start of the bankruptcy that operations would continue as usual during the court process.[31]

Ahead of the bankruptcy filing, WSJ reported that the KKR fund that owns Envision had already written off the investment, and “still had a net annualized return of 19%, according to people familiar with the matter.”[32]

Medical debt is one of the leading causes of bankruptcy in the United States,[33] and surprise medical billing has likely contributed to this issue.[34] Yet, unlike the ordinary Americans who may end up in life-changing bankruptcies because of their medical debt, and the workers who are have been laid off at Envision, it seems Envision’s former private equity investors and leadership will be able to move on with little consequence.

For further reading on Envision Healthcare from PESP:

- Blog post: “It should come as no surprise that KKR-owned Envision Healthcare has finally declared bankruptcy.” June 2023.

- Blog post: “Private equity investors in healthcare finally face the music.” May 2023.

- Blog post: “No Surprises Here: PE takes center stage in the No Surprises IDR process.” January 2023.

- Blog post: “KKR’s investors should be asking questions around Envision Healthcare bankruptcy risk.” January 2023.

- Report: “Envision Healthcare: A Private Equity Case Study.” December 2022

[1] businesswire.com. “Envision Healthcare Announces Successful Confirmation of Plans of Reorganization,” October 11, 2023. https://www.businesswire.com/news/home/20231011719176/en/Envision-Healthcare-Announces-Successful-Confirmation-of-Plans-of-Reorganization.

[2] Knauth, Dietrich. “Bankrupt Envision Healthcare Approved to Split in Two, Cut Debt.” Reuters, October 11, 2023, sec. Healthcare & Pharmaceuticals. https://www.reuters.com/business/healthcare-pharmaceuticals/bankrupt-envision-healthcare-gets-ok-split-two-cut-7-bln-debt-2023-10-11/.

[3] Knauth, Dietrich. “Bankrupt Envision Healthcare Approved to Split in Two, Cut Debt.” Reuters, October 11, 2023, sec. Healthcare & Pharmaceuticals. https://www.reuters.com/business/healthcare-pharmaceuticals/bankrupt-envision-healthcare-gets-ok-split-two-cut-7-bln-debt-2023-10-11/.

[4] Stinnet, Joel. “Envision Healthcare Completes $9.9 Billion Sale to KKR.” Nashville Business Journal. Accessed October 13, 2022. https://www.bizjournals.com/nashville/news/2018/10/11/completion-of-9-9b-deal-leaves-nashville-with-one.html.

[5] Brooke, David, and David Weinman. “Envision US$5.45bn TLB Sinks as US Healthcare Debate Rages.” Reuters, August 28, 2019. https://www.reuters.com/article/envision-us545bn-tlb-sinks-as-us-healthc-idCNL2N25O14W.

[6] Ronalds-Hannon, Eliza, and Davide Scigliuzzo. “The Debt Deal That Shows How Ugly Things Are Getting for Lenders.” Bloomberg.Com, October 5, 2022. https://www.bloomberg.com/news/articles/2022-10-05/kkr-s-envision-deal-shows-how-ugly-creditor-battles-are-getting.

[7] Appelbaum, Eileen, and Rosemary Batt. “Envision Healthcare Hits the Skids.” The American Prospect, March 14, 2022. https://prospect.org/api/content/dee32e40-a176-11ec-bb52-12f1225286c6/.

[8] Ronalds-Hannon, Eliza, and Davide Scigliuzzo. “The Debt Deal That Shows How Ugly Things Are Getting for Lenders.” Bloomberg.Com, October 5, 2022. https://www.bloomberg.com/news/articles/2022-10-05/kkr-s-envision-deal-shows-how-ugly-creditor-battles-are-getting.

[9] Appelbaum, Eileen, and Rosemary Batt. “Envision Healthcare Hits the Skids.” The American Prospect, March 14, 2022. https://prospect.org/api/content/dee32e40-a176-11ec-bb52-12f1225286c6/.

[10] Pg. 8; “Declaration of Paul Keglevic, Chief Restructuring Officer of Envision Healthcare Corporation, In Support of the Debtor’s’ Chapter 11 Petitions.” United States Bankruptcy Court for the Southern District of Texas Houston Division, May 15, 2023. https://www.courtlistener.com/docket/67385012/2/envision-healthcare-corporation/.

[11] Knauth, Dietrich. “Bankrupt Envision Healthcare Approved to Split in Two, Cut Debt.” Reuters, October 11, 2023, sec. Healthcare & Pharmaceuticals. https://www.reuters.com/business/healthcare-pharmaceuticals/bankrupt-envision-healthcare-gets-ok-split-two-cut-7-bln-debt-2023-10-11/

[12] Hatton, Riz. “What to Know about Envision’s ASC Ownership Swap.” Becker’s ASC Review, October 25, 2023. https://www.beckersasc.com/asc-transactions-and-valuation-issues/what-to-know-about-envisions-asc-ownership-swap.html.

[13] Cooper, Zack, Fiona Scott Morton, and Nathan Shekita. “Surprise! Out-of-Network Billing for Emergency Care in the United States.” Cambridge, MA: National Bureau of Economic Research, July 2017. https://doi.org/10.3386/w23623.

[14] American Medical Association. “Implementation of the No Surprises Act.” Accessed October 26, 2022. https://www.ama-assn.org/delivering-care/patient-support-advocacy/implementation-no-surprises-act.

[15] CMS.gov. “Surprise Billing & Protecting Consumers.” CMS.gov, January 14, 2022. https://www.cms.gov/nosurprises/Ending-Surprise-Medical-Bills.

[16] Appelbaum, Eileen, and Rosemary Batt. “Envision Healthcare Hits the Skids.” The American Prospect, March 14, 2022. https://prospect.org/api/content/dee32e40-a176-11ec-bb52-12f1225286c6/.

[17] CMS.gov. “Surprise Billing & Protecting Consumers.” CMS.gov, January 14, 2022. https://www.cms.gov/nosurprises/Ending-Surprise-Medical-Bills.

[18] Pg. 3; “Declaration of Paul Keglevic, Chief Restructuring Officer of Envision Healthcare Corporation, In Support of the Debtor’s’ Chapter 11 Petitions.” United States Bankruptcy Court for the Southern District of Texas Houston Division, May 15, 2023. https://www.courtlistener.com/docket/67385012/2/envision-healthcare-corporation/.

[19] Arnsdorf, Isaac. “Medical Staffing Companies Cut Doctors’ Pay While Spending Millions on Political Ads.” ProPublica, April 20, 2020. https://www.propublica.org/article/medical-staffing-companies-cut-doctors-pay-while-spending-millions-on-political-ads.

[20] Lagasse, Jeff. “Humana CEO to Step down, Hand Reins to Replacement in 2024.” Healthcare Finance News, October 11, 2023. https://www.healthcarefinancenews.com/news/humana-ceo-step-down-hand-reins-replacement-2024.

[21] Lauerman, John, and John Tozzi. “Humana Says Envision’s Rechtin to Succeed Broussard as CEO.” Bloomberg.Com, October 11, 2023. https://www.bloomberg.com/news/articles/2023-10-11/humana-says-envision-s-rechtin-to-succeed-broussard-as-ceo.

[22] Wallace, Claire. “Envision Healthcare CEO Leaves for Humana Following AmSurg Split.” Becker’s ASC Review, October 12, 2023. https://www.beckersasc.com/asc-news/envision-healthcare-ceo-leaves-for-humana-following-amsurg-split.html.

[23] Lagasse, Jeff. “Humana CEO to Step down, Hand Reins to Replacement in 2024.” Healthcare Finance News, October 11, 2023. https://www.healthcarefinancenews.com/news/humana-ceo-step-down-hand-reins-replacement-2024.

[24] Dyrda, Laura. “UnitedHealth Policies Drive Physicians to Optum, Lawsuit Claims.” Becker’s ASC Review, May 9, 2022. https://www.beckersasc.com/asc-news/united-policies-drive-physicians-to-optum-lawsuit-claims.html.

[25] Sweeney, Evan. “As UnitedHealth Negotiations Intensify, Envision Targets Surprise Billing with New Marketing Blitz.” Fierce Healthcare, October 4, 2018, sec. Fierce Healthcare Homepage, Hospitals, Finance. https://www.fiercehealthcare.com/payer/envision-emcare-surprise-billing-emergency-care-network-unitedhealthcare.

[26] Liss, Samantha. “UnitedHealthcare Fires Back, Sues Envision for Allegedly Exaggerating Patient Claims.” Healthcare Dive, September 12, 2022. https://www.healthcaredive.com/news/unitedhealthcare-lawsuit-envision-upcoding/631611/.

[27] Moody’s Investor Service. “Moody’s Downgrades Envision Healthcare Corporation to C, Outlook Stable.” Moodys.com, September 21, 2022. https://www.moodys.com/research/Moodys-downgrades-Envision-Healthcare-Corporation-to-C-outlook-stable-Rating-Action–PR_469479.

[28] Lauerman, John, and John Tozzi. “Humana Says Envision’s Rechtin to Succeed Broussard as CEO.” Bloomberg.Com, October 11, 2023. https://www.bloomberg.com/news/articles/2023-10-11/humana-says-envision-s-rechtin-to-succeed-broussard-as-ceo.

[29] Ickes, Amelia. “Envision Physician Services to Lay off 90 Florida Physicians, Healthcare Providers.” Becker’s Physician Leadership, April 3, 2023. https://www.beckersphysicianleadership.com/physician-workforce/envision-physician-services-to-lay-off-90-florida-physicians-healthcare-providers.html.

[30] Condon, Alan. “Envision Plans Layoffs in New York, Pennsylvania.” Becker’s Hospital Review, May 11, 2023. https://www.beckershospitalreview.com/finance/envision-plans-layoffs-in-new-york-pennsylvania.html.

[31] Envision Healthcare Reaches Restructuring Agreement. “Envision Healthcare Reaches Restructuring Agreement.” News.envisionhealth.com, May 15, 2023. https://news.envisionhealth.com/envision-healthcare-reaches-restructuring-agreement/.

[32] Gottfried, Miriam, and Alexander Saeedy. “WSJ News Exclusive | KKR-Backed Envision Healthcare Plans Chapter 11 Bankruptcy Filing.” Wall Street Journal, May 9, 2023, sec. Markets. https://www.wsj.com/articles/kkr-backed-envision-healthcare-plans-chapter-11-bankruptcy-filing-2fff4382.