The Carlyle Group’s fundraising failure

December 13, 2023

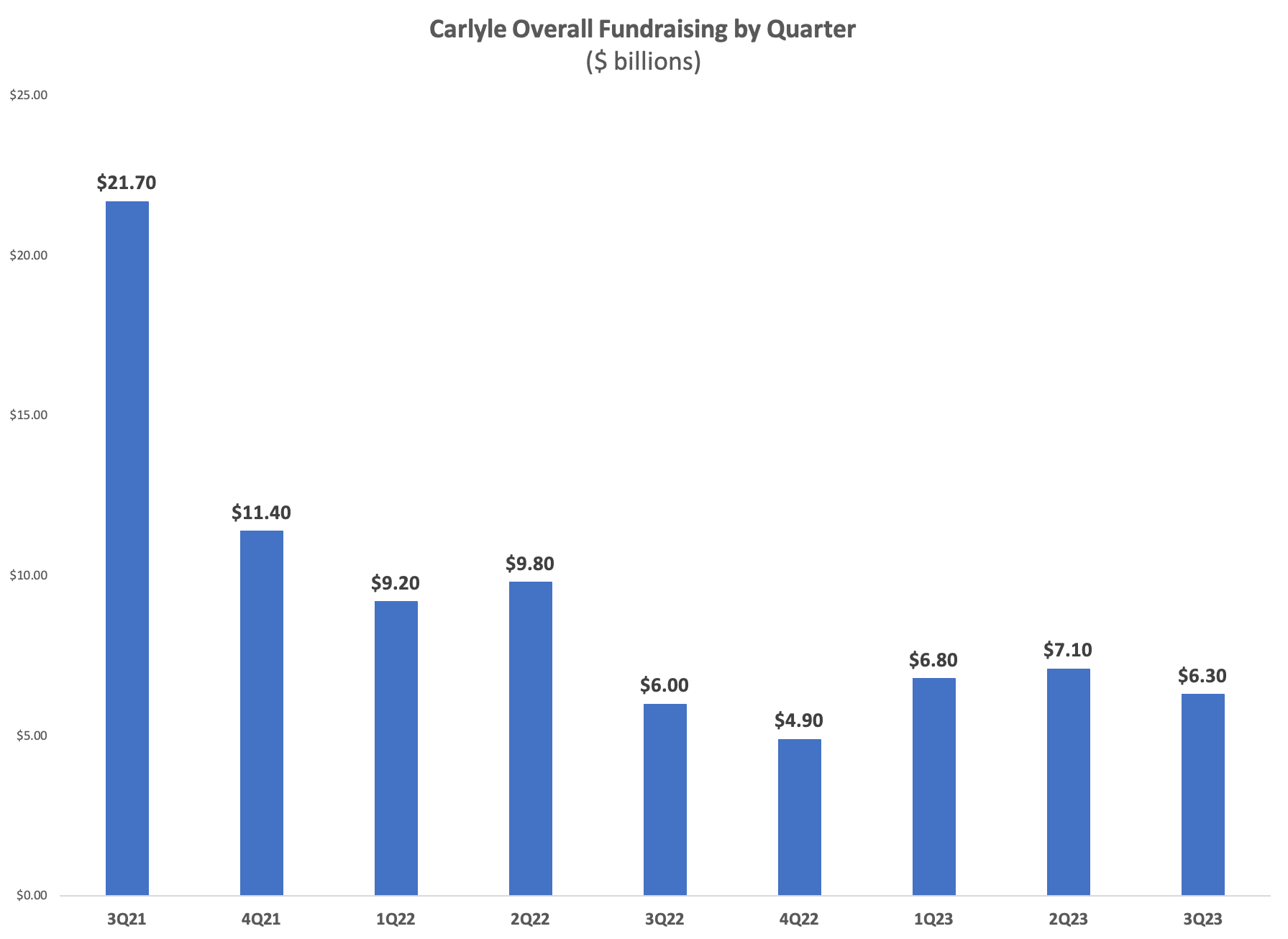

The Carlyle Group’s two-year fundraising journey for its flagship buyout fund, Carlyle Partners VIII, closed in August raising an abysmal 54 percent of its $27 billion goal and overall 20 percent less than what the firm raised for its predecessor private equity buyout fund. “Overall we have not been pleased with fundraising in 2023”, Harvey Schwartz, Carlyle’s Chief Executive stated in response to the lackluster fund closing. The firm also reported a 43% drop in third-quarter earnings and stated “Every single expense is on the table” as Carlyle seeks to turn things around with a sense of “urgency.”

Carlyle’s earnings slump and fundraising failure occurred at the same time as scrutiny of the firm for its fossil fuel investments from global mediaoutlets and environmental groups increased and a tumultuous period of high turnover among key Carlyle private equity staff and executives began. Bloombergreported “leadership shifts made some big institutions more reluctant to pony up money for flagship buyout strategies.”

Source: Carlyle Quarterly Financial Results Q3 2021- Q3 2023

Carlyle fails to get previous investors to recommit

Schwartz reportedly met with over 200 large institutional investors around the world, including a trip to the Future Investment Initiative hosted by Mohammed bin Salman in Saudi Arabia in an attempt to raise money ahead of the fund’s closing. Schwartz also personally asked Carlyle founder David Rubenstein to become more involved in fundraising, Bloomberg reported. The two have reportedly held numerous investor meetings together. Still, several large investors that committed to Carlyle’s last buyout fund appear not to have recommitted to Carlyle Partners VIII, and some that did committed significantly less, based on publicly available information.[1]

Public pension investors’s commitments to Carlyle Partners VII & VIII

| Limited Partner | Carlyle Partners VII (2018) | Carlyle Partners VIII (2022) |

| Washington State Investment Board | $600,000,000 | $300,000,000 |

| California Public Employees’ Retirement System | $500,000,000 | $375,000,000 |

| California State Teachers’ Retirement System | $500,000,000 | $0 |

| Canada Pension Plan Investment Board | $500,000,000 | $350,000,000 |

| State Teachers Retirement System of Ohio | $200,000,000 | $0 |

| Florida State Board of Administration | $100,000,000 | $0 |

| Texas County & District Retirement System | $100,000,000 | $0 |

| Greater Manchester Pension Fund | $50,000,000 | $0 |

| South Yorkshire Pensions Authority | $25,000,000 | $0 |

| Merseyside Pension Fund | $9,000,000 | $0 |

The California State Teachers’ Retirement System (CalSTRS) made a commitment of around $250 million to Carlyle Partners VI (2013) and a $500 million commitment to Carlyle Partners VII (2017), yet appears to have not committed to Carlyle’s latest fund.[2] Other large funds like California Public Employees’ Retirement System (CalPERS), Washington State Investment Board, and Canada Pension Plan Investment Board maintained their relationship with Carlyle after consistent commitments to previous funds, though invested significantly less this time around.[3]

Carlyle’s fossil fuel investments draw scrutiny

In addition to challenging fundraising and staff and executive turnover, Carlyle has also faced growing scrutiny for its substantial investments in “carbon-based energy.”

The firm’s fossil fuel investments were highlighted by The New York Times in October 2021 citing PESP’s report, Private Equity Propels the Climate Crisis. Carlyle ranked last among its peers on the 2022 Private Equity Climate Risks Scorecard earning an “F”, which was profiled in The Guardian.

Carlyle’s Co-Founder and Co-Chair David Rubenstein also faced criticism and calls by advocatesand community groups for him to resign from his board seats at institutions like the Kennedy Center, the Harvard Corporation, and the National Gallery of Art.

BREAKING: Billionaire businessman @DM_Rubenstein is one of private equity’s worst offenders on climate. He’s also a Harvard University trustee.

This is a clear conflict of interest — and why, yesterday, students rallied with a clear message: Rubenstein, Recuse or Resign. pic.twitter.com/HOOmzOZQK7

— Fossil Fuel Divest Harvard 🔶 (@DivestHarvard) May 11, 2022

David Rubenstein ultimately resigned from his position at the Harvard Corporation following a student organized protest on campus.

An April 2023 analysis of Carlyle’s Hidden Climate Impact found that the firm’s lopsided energy portfolio has approximately $22.4 billion in carbon-based energy, and $1.4 billion committed to renewable and sustainable energy companies. Meaning, for every $1 Carlyle invested in renewable energy sources, it invested $16 in fossil fuels.[4] The firm’s 2011-2022 carbon footprint was an estimated 277 million metric tons of carbon dioxide equivalent, roughly the same as the “carbon bomb” Willow drilling project in Alaska, The Guardianreported.

References

[1] Pitchbook

[2]“Private Equity Portfolio Performance June 2022,” CalSTRS, accessed November 29, 2023, https://www.calstrs.com/private-equity-portfolio-performance-table.

[3]“Private Equity Program Fund Performance Review,” CalPERS, accessed November 30, 2023, https://www.calpers.ca.gov/page/investments/about-investment-office/investment-organization/pep-fund-performance; “Private Equity Portfolio Overview by Stratedgy December 31, 2022,” WSIB, accessed November 29, 2023, https://www.sib.wa.gov/docs/reports/quarterly/ir123122.pdf; “Private Equity Relationships Established as at June 30th, 2022,” CPP Investments, accessed November 29, 2023, https://www.cppinvestments.com/wp-content/uploads/2022/11/Private_Equity_EN_Q2F2023.html.

[4]“The Carlyle Group’s Hidden Climate Impact,” Private Equity Climate Risks, April 21, 2023, https://peclimaterisks.org/the-carlyle-groups-hidden-climate-impact/.