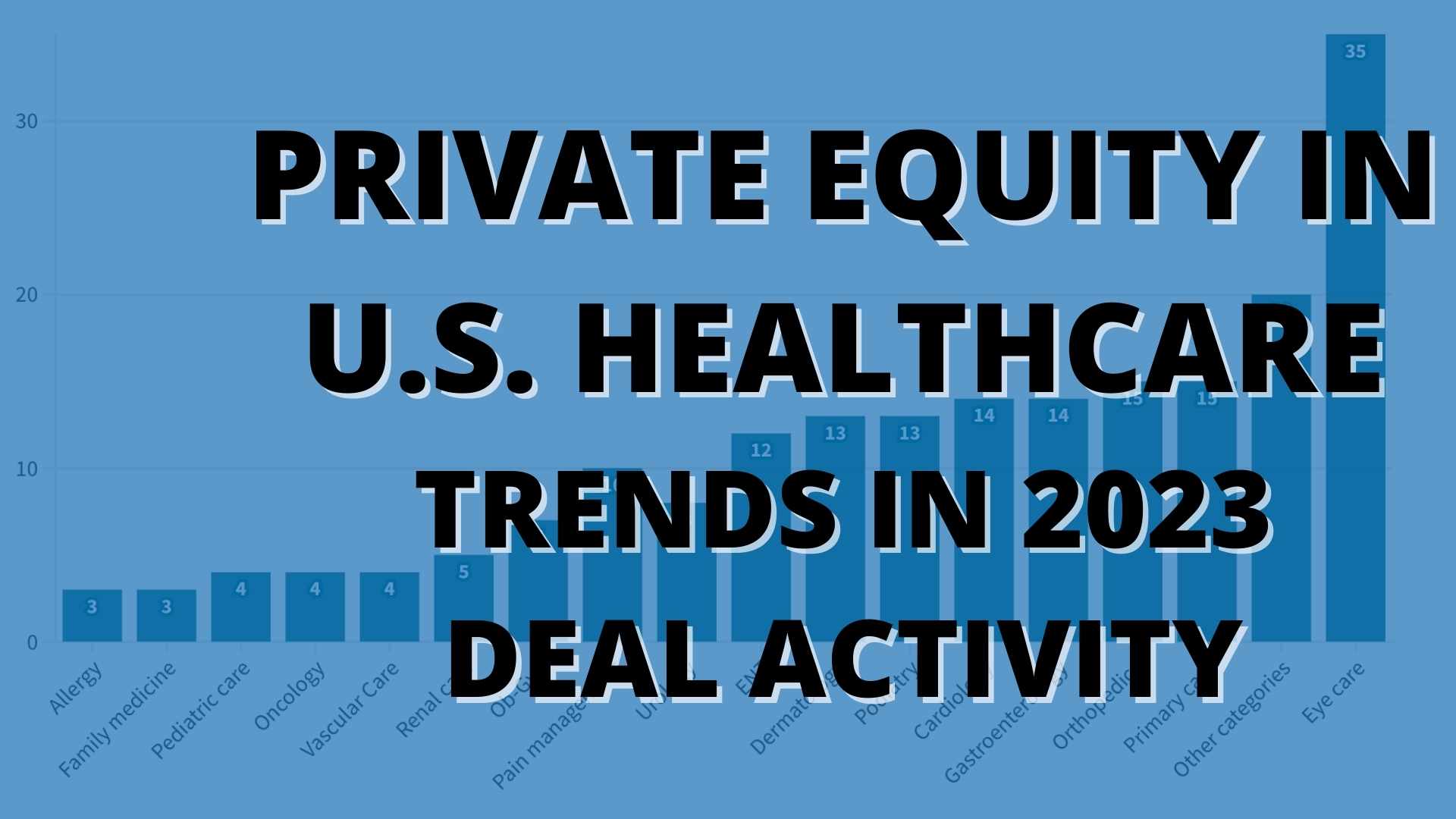

PESP director testifies at Senate HELP committee hearing

“When Health Care Becomes Wealth Care: How Corporate Greed Puts Patient Care and Health Workers at Risk” PESP healthcare director Eileen O’Grady testified this month at a field subcommittee hearing of the U.S. Senate Health, Education, Labor and Pensions…