Private Equity in U.S. Healthcare

Trends in 2023 Deal Activity

By Mary Bugbee, Eileen O’Grady, and Michael Fenne

Overview

In light of growing investor interest in healthcare and the risks associated with private equity ownership of healthcare companies, the Private Equity Stakeholder Project (PESP) publishes monthly blog posts that track private equity-backed healthcare acquisitions. This report looks at the 2023 private equity deals data in review, identifying and analyzing recent major investment trends in healthcare.

Click here to view a catalog of our monthly acquisitions blog posts for 2023.

You can download a printable PDF version of this report.

Table of Contents

- Outpatient care

- Eye care

- Gastroenterology

- Cardiology

- Oncology

- Dental care

- Medtech

- Medical aesthetics

- Behavioral health

- Therapeutic foster care

- Disability services

- Applied behavioral analysis (ABA)

- Clinical research

- Home health, home care, and hospice

- Fertility treatment

- Outpatient care

Conclusion & Policy Recommendations

Key Points

- Historically, a combination of factors has made healthcare an optimal space for private equity investment: a permanent demand for healthcare services, an aging population defined by a high disease burden, and the fact that many subsectors within healthcare are fragmented and therefore ripe for consolidation.

- 2023 was the second year in decline for private equity dealmaking in healthcare from its peak in 2021. This is in part due to macroeconomic challenges impacting most sectors, such as high interest rates and labor shortages.

- Despite the headwinds, many private equity firms continued to invest in the healthcare space. PESP identified 1135 unique deals, consisting of 148 buyouts, 259 growth/expansion investments, and 728 add-on acquisitions to 422 unique platform companies in 2023. These deals involved approximately 675 private equity firms, business development corporations, venture capital firms, private credit funds, and other types of investors.

- Some investors were more active than others. There were at least 22 private equity firms in 2023 that executed 10 or more healthcare deals. The most active firm by deal count was Quad-C Management, which executed 31 add-on acquisitions.

- Outpatient care deals, dental care, health IT, and medtech were the busiest subsectors among those PESP tracked. Biotech, pharmaceuticals, and medical aesthetics were also hot dealmaking areas.

- Private equity’s growing presence in the health sector and propensity for consolidation of healthcare services is cause for concern. The common private equity strategy of pursuing outsized returns over relatively short periods of time can lead to cost-cutting efforts that negatively impact patients and workers. Further, private equity firms often use debt to fund their investments, leading to unwieldy debt service obligations that can divert money away from patient care and fair compensation for employees.

- In the past couple of years, private equity’s use of debt to fund its healthcare investments has become a major liability as interest rates have risen. These high debt burdens can make it difficult for companies to dynamically respond to a changing regulatory landscape and volatile market conditions while meeting their debt service obligations.

- Major private equity-owned healthcare companies that declared bankruptcy in 2023 include Envision Healthcare, GenesisCare, Air Methods, and American Physician Partners.

- In light of continued investor interest in healthcare and the risks associated with private equity ownership of healthcare companies, regulators and lawmakers should scrutinize private equity acquisitions of healthcare companies more closely and pass and implement commonsense policies to ensure access to affordable and quality healthcare for all patients in the US.

Summary of findings

See Appendix A for a detailed methodology of how PESP arrived at the numbers in this report.

In 2022, PESP tracked 1135 private equity-backed healthcare deals, consisting of 259 growth/expansion investments, 148 leveraged buyouts, and 728 add-on acquisitions to 422 unique platform companies. These deals[1] involved approximately 675 private equity firms, business development corporations, venture capital firms, private credit funds, and other types of investors.

Some investors were more active than others. There were at least 22 private equity firms in 2023 that executed 10 or more healthcare deals. The most active firm by deal count was Quad-C Management, which executed 31 add-on acquisitions. See Table 1 for a list of firms.

Add-on acquisitions to private equity-owned platform companies accounted for 64 percent of the private equity-backed healthcare deals in 2023. Some investors were particularly busy rolling up companies via this common private equity strategy. See Table 2 for the platform companies with the highest deal count in 2023.

Private equity-backed healthcare acquisitions remained steady throughout most of the year, before tapering off in the last quarter. The most deal activity occurred in January (141 deals), June (109 deals), and September (102 deals). See Figure 2. The January deal count was particularly high and may be the result of a disproportionate number of deals being announced at the start of the year.

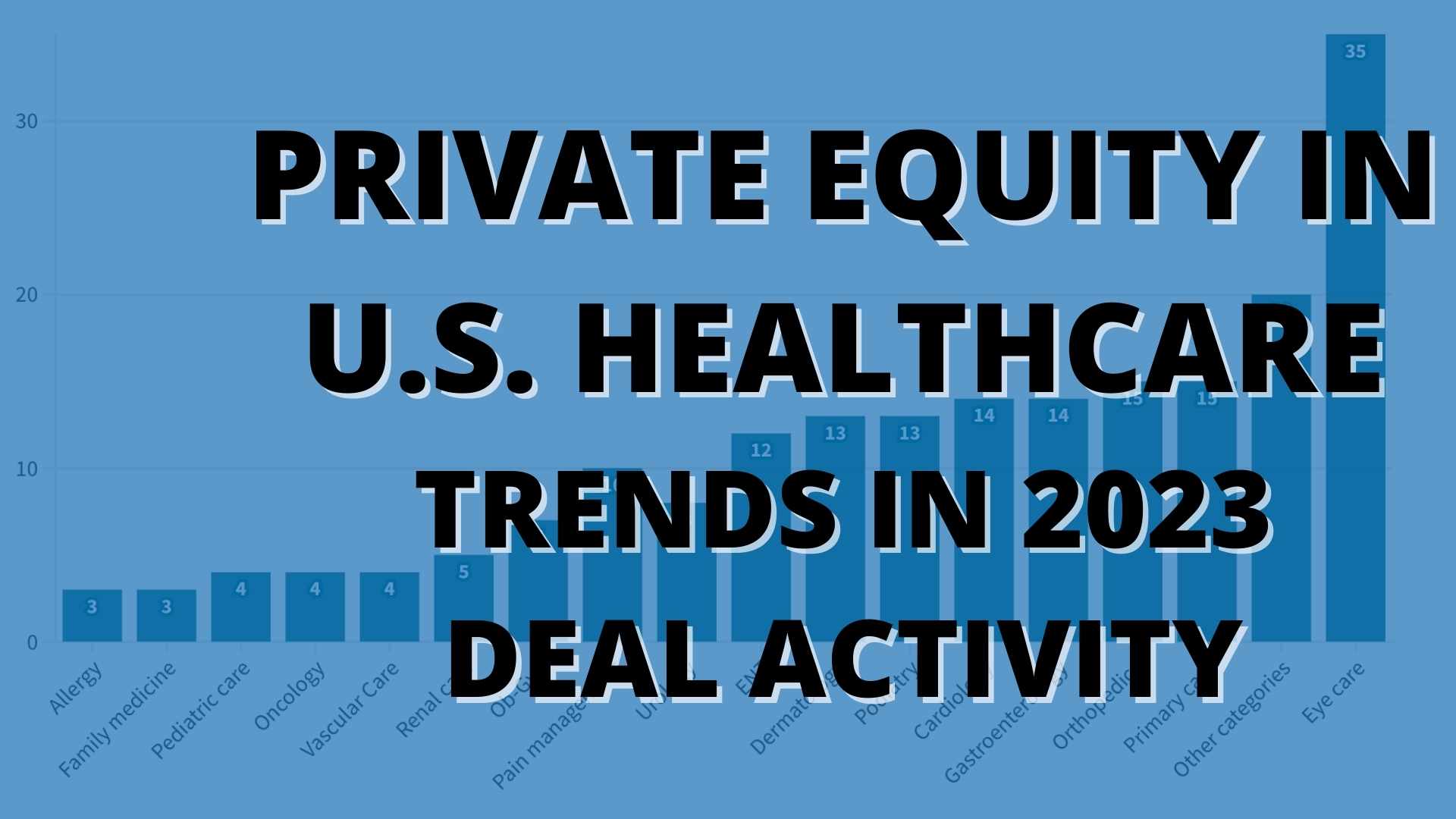

Some healthcare subsectors saw significantly more deal activity than others. Figure 3* shows the top categories for deal activity, with outpatient care, dental care, health IT, and medtech dominating the list.

*Some companies are classified under more than one category, so certain deals may be double counted in Figure 3.

Private equity dealmaking context in 2023

Private equity firms are drawn to investing in sectors defined by fragmented markets and high demand, where they can deploy capital to consolidate small time players into powerhouse companies with outsized shares of the market.

A combination of factors has historically made healthcare an optimal space for private equity investment: a permanent demand for healthcare services, an aging population defined by a high disease burden, and the fact that many subsectors within healthcare are fragmented and therefore ripe for consolidation.

For these reasons, the healthcare sector has a reputation for being “recession resilient” and has remained a thriving private equity investment area. However, 2023 saw a decline in private equity dealmaking in healthcare for the second year in a row.[2] This is due in part to macroeconomic challenges impacting most sectors, such as high interest rates and labor shortages.[3] The high interest rate environment in 2023 made it more challenging to secure financing for debt-funded deals, leading to a significant decline in private equity deal activity, overall.[4] According to WSJ, global deal activity decreased 40 percent to $846 billion from $1.44 trillion in 2022.[5]

Despite the headwinds, many private equity firms continued to invest in the healthcare space. Outpatient care deals, dental care, health IT, and medtech were the busiest subsectors among those PESP tracked. Biotech, pharmaceuticals, medical aesthetics were also hot dealmaking areas. See Figure 3.

The next section will take deeper dives into select subsectors that PESP has identified as areas of interest.

Deeper Dives

Outpatient Care

Of all categories tracked by PESP, outpatient care had the most deals at 195 (11 buyouts, 24 growth/expansion investments, and 160 add-on acquisitions).

*Some companies are classified under more than one category, so certain deals may be double counted in Figure 4.

Eye Care

Eye care was by far the hottest subcategory of outpatient care in 2023. At 35 deals, it had more than double the deals than the next highest categories (primary care and orthopedics, with 15 deals each). Two private equity-backed platform companies accounted for approximately 43 percent of the total deal count: Unifeye Vision Partners, owned by Waud Capital Partners, made 8 add-on acquisitions and InFocus Eyecare, owned by Regal Healthcare Capital Partners, made 7 add-on acquisitions.

Regal Healthcare Partners formed InFocus Eyecare as a platform company in 2022.[6] It already has 23 locations across 6 states.[7] Unifeye Vision Partners was formed by Waud Capital and Minnesota Eye Consultants in 2017[8] and has 22 partners and over 42 locations[9] across 4 states.[10]

According to Eric Major of Provident Healthcare Partners, “The eye care sector represents a highly attractive opportunity for private equity given the ability to combine payor-based surgical and primary eye care with cash-based optical products and services that mitigate government reimbursement risk inherent in healthcare services businesses.”[11]

Researchers and reporters have tried to unpack the impact of private equity investment in eye care. One 2022 study found increased spending and utilization for private equity-backed ophthalmology practices (as well as for gastroenterology and dermatology).[12]

In September 2022, KHN released an investigative report detailing private equity’s increased interest in this specialty. One expert estimated that private equity firms may now work with as much as 8% of ophthalmologists in the US. KHN’s analysis suggests that private equity firms are investing in practices that are higher volume and therefore more profitable.[13]

Gastroenterology

There were 14 gastroenterology deals in 2023, consisting of two growth investments, 11 add-ons to private equity-backed platform companies, and one buyout. The buyout was of United Digestive, a gastroenterology physician practice management firm with over 200 providers across 80 locations in the southeastern U.S., which was acquired by private equity firm Kohlberg and Company, ending its affiliation with Frazier Healthcare Partners.[14] Frazier Healthcare created United Digestive as a platform company in 2018.[15]

Gastroenterology is a relatively new specialty on which private equity has set its sights, with acquisitions accelerating after 2017. Despite its relative newness as an investment target, Physician Growth Partners reported that by Fall 2021, nearly 10% of gastroenterologists were partners or employed by a private equity platform.[16]

Several forces appear to be driving investor interest in gastroenterology. An aging population means more people are getting colonoscopies to screen for colorectal cancer, and for patients age 65 and older these screenings are covered entirely by Medicare. In 2021 the CDC lowered the recommended age for colorectal cancer screening from age 50 to 45,[17] in part due to increasing incidence of early-onset colorectal cancer in younger adults.[18]

These factors have increased demand for gastroenterology services, aggravating a shortage of gastroenterology providers. The Health Resources and Services Administration (HRSA) estimated in 2016 that by 2025, the US will face a shortage of more than 1,600 gastroenterologists nationwide.[19]

Finally, the gastroenterology industry has historically been fragmented, creating opportunities for private equity firms to use platform companies to buy up and consolidate providers.[20] See Table 3 for the private equity-backed gastroenterology platform companies active in 2023.

Cardiology

In cardiology, Webster Equity Partners and MedEquity Partners were busy in 2023, rolling up 8 cardiology practices to their platform company Cardiovascular Associates of America (CAA). CAA has over 149 locations across 8 states and serves over one million patients.[21] Of the 14 cardiology deals tracked, CAA’s add-ons accounted for over 50 percent.

Analysts, researchers, and healthcare journalists have recently noted private equity’s increased interest in cardiology.[22] The sector is attractive for its size: Heart disease is the leading cause of death in the U.S. and costs more than $200 billion per year in healthcare and lost productivity.[23]

And with over 40 percent of Americans considered medically obese and an aging population, demand for cardiology services is high while cardiologists are in short supply. The industry is still highly fragmented, offering opportunities for investors to use a consolidation strategy to generate profits.[24]

Oncology

While there were only 4 oncology deals that PESP tracked in 2023, all four deals involved the same platform company, a physician practice management company called OneOncology.

TPG Capital acquired OneOncology in June 2023 in a reported $2.1 billion deal,[25] with a minority stake from AmerisourceBergen.[26] It was previously owned by private equity firm General Atlantic, which acquired a majority stake in the company in 2018 for $200 million.[27]

According to consulting group Chartis, the presence of both TPG and AmerisourceBergen made this deal both a vertical and horizontal integration opportunity. AmerisourceBergen, now under the name Cencora, is a wholesale drug distributor. By becoming a minority investor in the deal, it was able to secure its status as OneOncology’s drug distributor. In a May 2023 article published on its website, Ryan Langdale of Chartis stated that he “would expect OneOnc to continue being aggressive in acquiring practices, expanding via local tuck-ins, and vertically integrating ancillary businesses like imaging, radiotherapy, and retail pharmacy. There are really interesting adjacent plays to be made by a platform of One Oncology’s size—like monetization of its data and expanding industry-funded clinical trials…”[28]

The month before its sale to TPG Capital, OneOncology acquired two new practices: Coastal Cancer Center in Myrtle Beach, SC and Pacific Cancer Care in Monterey, CA. The deals brought OneOncology’s reach to 18 practices across 14 states.[29] In November 2023, OneOncology added another practice, Mid-Florida Cancer Centers, bringing the total to 19 practices.[30]

Private equity investment in oncology services has grown in recent years. A recent study published in JAMA in May 2023 found that over 700 oncology clinics were acquired by or affiliated with a private equity firm between 2003 and 2022. Just 23 private equity-owned platforms accounted for the deals. In seven states, private equity-backed providers accounted for over a quarter of all oncology clinics.[31]

The JAMA study’s authors explain that “As increasing consolidation continues to affect the landscape of independent oncology practices, patients may face additional barriers to both accessibility and affordability of care.”[32]

In an editorial response to the study, Cary P. Gross, MD, of Yale School of Medicine and two other physicians commented that private equity firms may be attracted to oncology in part due to “profit potential directly related to the volume of chemotherapy administered and payment of oncologists as a percentage of the sales price of these increasingly high-priced drugs.”[33] Currently, oncologists are reimbursed at 106 percent of the average sales price for drugs.[34]

High potential to profit for cancer treatment may not be enough to buoy the high debt loads characteristic of many private equity-owned companies; international radiotherapy giant GenesisCare, backed by KKR, filed for Chapter 11 bankruptcy on June 1, 2023 after struggling under a debt load stemming in part from the private equity firm’s $1.5 billion takeover.[35]

Dental care

Dental care saw the second highest number of deals (146) in 2023 of any category PESP tracked. These deals were primarily driven by 5 very active platform companies which collectively made 71 acquisitions: Specialized Dental Partners (owned by Quad-C Management) with 31 add-on acquisitions, U.S. Oral Surgery Management (owned by Oak Hill Capital) with 11 add-ons, Southern Orthodontic Partners (owned by Shore Capital Partners) with 10 add-ons, Smile Doctors (owned by AlpInvest Partners, Linden Capital Partners, and Thomas H. Lee Partners) with 9 add-ons, and Dental 365 (owned by The Jordan Company and Regal Healthcare Partners) with 8 add-ons.

These platform companies focus on not only general dentistry, but dental specialties, as well, such as endodontics and oral surgery.

Private equity firms have increasingly been investing in the US dental industry through Dental Services Organizations (DSOs). DSOs handle the business side of dental practices, such as administrative, marketing, bookkeeping, and financial services. As of 2021, private equity firms dominated the DSO market; 9 of the top 10 DSOs in the US were owned by private equity firms. Private equity firms owned 27 of the top 30 DSOs, accounting for 84% of practice locations affiliated with the top 30 firms.[36]

Private equity-owned DSOs have been found to employ cost cutting tactics that can hurt patient care, including pushing medically unnecessary or expensive procedures and understaffing while attempting to maximize patient volume.[37] These companies also provide an avenue for private equity firms to skirt around regulations. Both the DSO and physician practice management industries appear to have been created, largely by private equity firms, to avoid regulation that prohibits investor ownership of clinical practices.[38]

See our 2021 report for more information on private equity investments in dental care: “Deceptive Marketing, Medicaid Fraud, and Unnecessary Root Canals on Babies: Private Equity Drills into the Dental Care Industry.”

Medtech

Medtech was the fourth busiest healthcare category for private equity deals in 2023. There were 121 deals, consisting of 24 buyouts, 30 growth/expansion investments, and 67 add-on acquisitions. Medtech consists of the manufacturing, distribution, and sales of medical supplies, devices, and equipment, manufacturing, and related outsourcing.

Private equity deal value in healthcare devices and supplies saw a sharp upturn during the pandemic, increasing from $11.1 billion to $43.5 billion from 2020 to 2021—despite 2021 only seeing one more deal in this area than the previous year.[39] Additionally, in the decade leading up to 2022, private equity invested over $280 billion in medical technologies.[40]

However, 2023 saw fewer high value merger deals in the medtech sector compared to 2022.[41] One Medtech reporter describing the situation midyear wrote, “The few mergers and acquisitions that have closed so far this year are more to do with companies divesting units than buying in innovative technology. And several others have resulted from private equity firms shuffling their assets.”[42]

One of the largest deals of the year was Bain Capital’s acquisition of Evident, the microscopy subsidiary of Olympus, for $3.1 billion.[43]

Another acquisition early in the year was Carlyle Group’s add-on of Axial Medical to its platform company, Groupe Acrotec. Carlyle acquired Acrotec in February 2021, and is using the company as a platform to expand into services into Europe, Asia, and North America. The add-on company, Axial, was founded in 2014 and operates a 40,000 sq. ft. facility near Philadelphia, where it manufactures orthopedic implants for spine, trauma, and extremity treatments.[44]

Carlyle, alongside private equity firm GTCR, acquired Memry Corporation and SAES Smart Materials, Inc. from a company based in Italy via its platform company, Resonetics. The acquired companies are U.S. based, and have operations in Connecticut, New York, and California.[45]

In 2023, private equity firms made further inroads into the durable medical equipment (DME) industry, a subset of the medtech sector that includes wheelchairs, respiratory technology, and other tools needed to manage chronic conditions and disabilities.

BPOC’s DME company, Home Care Delivered, acquired the DME unit of Medline Industries, a medical supplies giant owned by a consortium of private equity firms including Blackstone, Carlyle Group, and Hellman & Friedman.[46] Home Care Delivered specializes in supplies for diabetes/CGM, incontinence, wound, urological, and ostomy products.[47]

In addition, Nordic Capital-owned Sunrise Medical acquired Ride Designs, which manufactures seating systems for wheelchairs.[48]

Private equity firms have increasingly bought up DME manufacturers and suppliers and consolidated them. Through aggressive debt-funded growth strategies, a handful of private equity-owned DME companies have grown from nonexistence to industry giants over the last decade.[49]

See PESP’s latest report Private Equity in DME: How Private Equity Profits Off of Disabled and Chronically Ill Americans (November 2023).

As private equity firms develop a larger footprint in the medtech industry, especially through vertical integration via the acquisition of upstream manufacturing companies, researchers and regulators need to interrogate any potentially anticompetitive deals that could drive up healthcare costs for hospitals, payers, and patients.

Medical aesthetics

With the seventh highest number of deals (55) in 2023 of the categories tracked by PESP, it is clear that private equity firms have significantly ramped up their investments in the medical aesthetics space. Medical aesthetics, which includes medspas, plastic surgery, injectables, and aesthetics-oriented laser and ultrasound technologies, is a growing industry that is seeing increased private equity activity. According to Boston Consulting Group (BCG), “about 15 million Americans have had an aesthetics procedure, but the pool of potential consumers is nearly six times that amount – roughly 80 million people.”[50] BCG projects double-digit growth rates for the medical aesthetics industry through 2027.[51]

Leon Capital Group’s 10 add-on acquisitions to Advanced MedAesthetic Partners (AMP) accounted for nearly 20 percent of the medical aesthetics deals in 2023. AMP was created as a platform company by Leon Capital in 2022,[52] and currently has over 30 locations in 14 states and over 440 employees.[53]

It is too early to fully understand the impacts of private equity’s growing presence in the medical aesthetics industry. However, researchers and regulators should be on the lookout for increased consolidation that could result in higher prices across the industry as well as the use of debt to finance acquisitions that may lead to cost-cutting practices, such as understaffing, that could impact patient care.

Behavioral health

PESP tracked 44 behavioral health deals in 2023.

ARC Health, a behavioral health platform company backed by Thurston Group and Five Points Capital, made 9 acquisitions in 2023, accounting for 20 percent of the total behavioral health deals. See Table 4.

Since its founding in 2021, ARC Health has made at least 18 add-on acquisitions.[63] It currently has over 1,400 providers across 100 locations in 20 states, and served 80,000 patients in 2023.[64]

In 2020, PESP published a report on private equity’s incursion into the behavioral health industry that discussed how private equity investment carries substantial risk for behavioral health services, including the potential for inadequate staffing or reliance on untrained and unlicensed staff, pressure on physicians to provide unnecessary and costly services, or abuse of federal funding programs at the expense of patient care.

Therapeutic foster care

Palladium Equity-owned Health Connect America (HCA) made three add-on acquisitions in 2023: First Home Care, North Star Counseling,[65] and Specialized Youth Services of Virginia.[66] First Home Care operates therapeutic foster care programs at four locations in Virginia. North Star provides behavioral therapy services and targeted case management focusing on children and their families and is based in Kissimmee, FL.[67] Specialized Youth Services is a private day school near Richmond, VA that serves at-risk youth.[68]

HCA and its subsidiaries treat a range of behavioral health needs, including conduct disorder, substance use disorder, autism, and emotional disturbance. It operates in Mississippi, Tennessee, Alabama, Georgia, Florida, North Carolina, South Carolina, and Virginia.[69]

HCA has grown substantially since Palladium acquired it, including five new add-on acquisitions in the first year and a half. Those acquisitions include Georgia HOPE, Pinnacle Family Services and Healing Educational Alternatives for Deserving Students (HEADS), which focus on therapeutic foster care, and behavioral health services for at-risk children and their families.[70]

This is not Palladium’s first foray into services for disadvantaged youth; in the same fund as HCA, Palladium also owns EverDriven (formerly ALC Schools)[71], a transportation company for foster students, students with disabilities, and students experiencing homelessness.[72]

Private equity investment in foster care, including therapeutic foster care, has previously garnered scrutiny for conditions that were harmful to youth. The largest for-profit foster care and disability services company, Sevita (formerly known as the Mentor Network), has faced numerous allegations of abuse, neglect, and deaths at its foster care and residential programs over the last two decades. Five private equity firms have owned the company throughout the entire period. Its current owners, Centerbridge Partners and the Vistria Group, have collected almost half a billion dollars in debt-funded dividends from Sevita in the last four years. [73]

Another embattled therapeutic foster care company is Sequel Youth & Family Services, which operates residential programs for at-risk youth, including youth in foster care and the juvenile justice system. Sequel has been owned by different private equity firms for at least 15 years. Reports of abuse and neglect at Sequel homes as well as pressure and investigations by state and local governments have led to over a dozen facility closures since 2019, including seven closures that occurred amid investigations by state and local agencies.[74]

Given that two of the country’s largest for-profit foster care and youth behavioral health companies have such records, HCA’s rapid expansion under Palladium Equity raises serious concern. Private equity firms should not be able to exploit vulnerable youth for profit. Advocates, regulators, and policymakers must closely scrutinize HCA and its subsidiaries to ensure that it does not follow the pattern of Sevita, Sequel, and others.

A report from PESP in 2022 identified cost-cutting tactics at private equity-owned youth behavioral health companies, such as cutting staff, relying on unlicensed staff, and failing to maintain facilities, which can lead to abuse, neglect, and unsafe living conditions for youth under the care of those companies.[75]

Disability services

PESP tracked 27 deals in the disabilities services category for 2023. Nearly half (13) of these deals involved applied behavioral analysis (ABA) providers.

Applied behavioral analysis (ABA)

ABA is a type of therapy provided to people with autism, and providers who offer it have become particularly attractive targets for investors due to the growing number of autism diagnoses and the fact that the “ABA industry charges tens of thousands of dollars per client per year for services insurers are legally obligated to cover,” according to STAT.[76]

Because of private equity’s typical playbook that aims to make outsized profits over short time horizons, private equity investment in autism services has recently come under scrutiny. Tara Bannow, writing for STAT, explains: “Families and clinicians who once believed fully in the promise of ABA say the financial investors’ fixation on profit has degraded the quality of services kids receive, turning it into the equivalent of fast food therapy.”[77]

In October 2023, private equity firm KKR’s portfolio company BlueSprig Pediatrics purchased Trumpet Behavioral Health and its 37 autism therapy locations.[78]

The acquisition came just months after the bankruptcy of one of the largest autism therapy companies in the US (CARD – owned by PE firm Blackstone Group) and nationwide closures of PE-owned autism centers (Invo Healthcare – owned by Golden Gate Capital).[79]

Clinical Research

In the clinical research space, PESP tracked 38 deals, consisting of 6 buyouts, 10 growth/expansion investments, and 22 add-on acquisitions. Under PESP’s categorization scheme, the clinical research category encompasses clinical trials facilities, contract research organizations, and other companies that conduct research for drug and medical device development.

KKR’s Headlands Research continued its expansion in 2023. It made 4 acquisitions: a company in Massachusetts now called Headlands Research Eastern Massachusetts in April,[80] Clinvest Research in May,[81] AMCR Institute in July,[82] and Clinical Research Professionals in October.[83] KKR created Headlands in 2019 with plans for aggressive growth through acquisitions of smaller research sites.[84] As of February 2024, Headlands had 17 sites in the U.S. and Canada.[85]

Flourish Research, a platform company formed owned by New Mainstream Capital that was founded in 2021,[86] made five new acquisitions in 2023: Central Research Associates, AMC Research,[87] and Alzheimer’s Memory Center in May,[88] Valley Clinical Trials in September,[89] and Merritt Island Medical Research in November.[90] Flourish Research currently has 15 sites across the US.[91]

Private equity firms have become increasingly drawn to clinical drug trials due to the large profits that can be gained through efficiencies, such as getting a drug to market sooner or for lower cost.[92]

In addition, the clinical research industry is fragmented, with opportunity for consolidation, and because unlike investment in pharmaceutical companies themselves, revenues will not depend on whether a drug makes it to market or not.[93]

According to the American Investment Council (the primary lobbying group that represents private equity firms in the U.S.[94]), “investors are able to dramatically improve the hundreds of service providers that play a vital role in health care innovation and patient care,” and that “PE Firms can help drastically reduce costs and make drug development much more efficient.”[95]

These claims raise the question: for whom can private equity generate a reduction of costs and increase in efficiencies? Drugs (especially expensive biologics) and medical devices continue to drive high health care costs in the United States that ultimately fall on the consumer via higher insurance premiums, hospital bills, and out-of-pocket expenses.[96]

With a focus on generating substantial profits over relatively short time horizons (4-7 years), private equity firms add another layer of profit extraction into an already convoluted healthcare industry. Without having to incur the risks of a drug or device failing to make it to market, private equity firms that invest in contract research organizations (CROs) can profit from medical research and development even if consumers do not benefit. Further, in the absence of price controls for pharmaceuticals and devices, any purported cost savings that private equity firms can help generate for life sciences research will not necessarily trickle down to the consumers. Lastly, increasing consolidation of CROs and other companies involved in research and development (R&D) has the potential to drive up the costs of R&D if some companies gain outsized market power and can then extract higher prices for the services they provide.

Given the exorbitant costs of prescription drugs, biologics, and medical devices in the United States, private equity’s growing presence in the clinical research is cause for concern and warrants further scrutiny from researchers and regulators.

Home health, hospice, and home care

While PESP considers home health, home care, and hospice as separate categories, many of the deals we tracked in 2023 involve companies that fall into more than one of these categories. PESP tracked 35 deals in home health, 18 in home care, and 13 in hospice. Note some deals are double counted if classified under more than one category. The total discrete number of deals across these three categories was 49.

There has been a growing trend of private equity investment in these industries. From 2018 and 2019, private equity was involved in almost 50 percent of deals in the home healthcare industry, and private equity hospice transactions rose nearly 25 percent between 2011 to 2020.[97] As of 2019, 7.3 percent of hospice agencies were owned by private equity, up from 3.4 percent in 2011.[98]

For-profit home healthcare and hospice companies have been linked to lower standards of care compared to their non-profit counterparts.[99] Private equity firms, which often target outsized returns over short time horizons and finance many of their acquisitions with high levels of debt, may exacerbate that divide.[100]

In March 2022, Private Equity Stakeholder Project released a report on private equity’s incursion into the home health and hospice industry. You can read the full report here.

Home health

A number of private equity-backed home healthcare companies continued to make acquisitions in 2023, including Lorient Capital Management’s PurposeCare with 4 add-on acquisitions, and Havencrest Capital Management’s Avid Health at Home with 3 add-on acquisitions.

Aveanna Healthcare, which is publicly traded but majority owned by private equity firms Bain Capital and J.H. Whitney Capital Partners,[101] was notably quiet in 2023, for the second year in a row. Bain and J.H. Whitney founded Aveanna in 2017 through a partnership when they merged two home-based pediatric healthcare companies—Epic Health Services and PSA Healthcare.[102] The firms oversaw a period of rapid debt-funded growth ending in 2021. Since then, Aveanna’s acquisition activity has grinded to a halt.[103]This is likely due to its high levels of debt and rising interest rates that are impacting its ability to obtain more financing.

Excessive debt levels may not only harm a healthcare company’s finances and ability to grow but can also have detrimental impacts on workers and the patients for whom they care. That is because debt service obligations can lead to harmful cost cutting tactics. In healthcare, these can include understaffing, wage and hour violations, relying on temporary and per diem staff over full-time workers, not investing in adequate training for workers, and overburdening clinician workloads.

In December 2022, Moody’s Investors Service included Aveanna Healthcare in a list of 34 healthcare companies at risk for default.[104] In its most recent rating action (November 2022), Moody’s cited “very aggressive financial policies” “constant misses of public earnings guidance,” and “very high financial leverage” as factors contributing to the downgraded rating, in addition to the outside factor of “persistent nursing labor shortages.”[105]

Hospice

Gentiva, a hospice chain owned by private equity firm Clayton, Dubilier & Rice (CD&R), acquired non-profit health system ProMedica’s home health and hospice business in November 2023. The deal adds 4,000 employees of ProMedica’s, bringing Gentiva’s total employee number to over 35,000.[106] The combined company now operates more than 615 facilities across 38 states and is the largest U.S. hospice company by revenue and number of patients.[107]

This is the first purchase Gentiva has made since CD&R acquired it (then known as a segment of Kindred at Home) from insurer Humana in 2022 for $2.8 billion.[108]

Private equity firms increasingly make up a disproportionate share of the hospice industry, particular through acquisitions of non-profit providers in recent years. In 2019, approximately 113,000 (8%) of the nation’s 1.46 million Medicare hospice beneficiaries were cared for by private equity-owned hospices – a 327 percent increase from 2012.[109]

In 2020, private equity acquisitions of hospice agencies surged, according to a report by the Center for Economic and Policy Research. By the end of 2021, private equity accounted for 18 out of a total of 23 deals involving hospice providers. While the hospice industry in 2022 saw a relative lull in dealmaking compared to previous years, “PE firms continue to be leading players in the market” wrote the report’s authors.[110]

Research comparing patient outcomes and other indicators at for-profit vs non-profit hospice companies raises red flags about the growing presence of private equity in the hospice industry. A 2019 report from the Government Accountability Office (GAO) found that hospices with the lowest quality ratings were most likely to be for-profit, although average quality remained similar.[111] For example, for-profit hospices were more likely than their non-profit counterparts to have low rates of home visits in the last days of life by health professionals and high rates of live discharge from hospice.[112]

A 2023 study by RAND Corporation published in JAMA Internal Medicine found that “family members reported worse care experiences on average from for-profit hospices across all of the domains assessed, including help for pain and other symptoms and getting timely care.”

Private equity, with its characteristic focus on increasing short term profits sometimes at the cost of patient care, may amplify the concerns raised about for-profit ownership of hospice providers. See, for example, PESP’s report on private equity ownership of hospice and home health providers: Private Equity at Home: Wall Street’s Incursion into the Home Healthcare and Hospice Industries (March 2022).

Home care

Private equity firms have been investing in the home healthcare industry for many years,[113] but it appears firms are now also entering into the home care space. Home care differs from home healthcare in that it consists of non-medical services to assist with activities of daily living, such as getting dressed, meal preparation, and more.[114]

One notable deal in the home care space was The Halifax Group’s acquisition of Comfort Keepers, the home care division of Sodexo, for an undisclosed amount on September 29, 2023.[115] Comfort Keepers has over 700 locations across eight countries. Its U.S. business primarily provides private pay nonmedical personal care.[116][117]

Team Services Group is a platform company that Alpine Investors created in 2015 that offers home care services[118] and employs over 75,000 caregivers and direct care workers.[119] In 2023, it made 3 add-on acquisitions financed by Alpine Investors, Hamilton Lane, HarbourVest Partners, Neuberger Berman, and Pantheon Capital Partners.

Private equity firms likely find home care attractive for a number of reasons. For starters, the US population is aging and there is a growing desire for Americans to age in place and receive care and healthcare services in the home, versus in assisted living and nursing facilities. In addition, home care companies do not have to compete for skilled nursing labor with other agencies and healthcare providers because their services are not medical in nature. Operational costs are likely lower as well, since companies do not need as much overhead to process insurance reimbursements and comply with state and federal healthcare regulations.

As such, nonmedical home care is an industry to keep an eye on as private equity becomes a bigger player. The typical private equity strategy of capturing greater market power in fragmented industries by consolidation could have the effect up driving up the cost of home care services. With the typical private equity focus on short term profit, cost cutting strategies could lead to poor working conditions and pay for caregivers, which could in turn translate to higher turnover and quality of care issues for clients. And, because home care services are not medical care, there is a much looser regulatory environment. Many states do not require training or licensing for individual caregivers.[120] A loose regulatory environment could make it more difficult for home care companies to be held accountable in instances where clients receive poor quality of care.

Fertility treatment

In fertility treatment, there were 9 deals PESP tracked in 2023 involving four different platform companies: Reproductive Medicine Associates (KKR), Ivy Fertility (InTandem Capital Partners), US Fertility (Amulet Capital Partners), and Fertility Specialists Network (LongueVue Capital).

KKR, through its platform RMA, acquired fertility treatment provider Conceptions Reproductive Associates of Colorado in August.[121] In November it acquired Boston IVF, which brought multiple academic affiliations along with it, including Harvard Medical School, Dartmouth Hitchcock Medical School, Boston University Medical Center, and Tufts Medical Center.[122]

RMA is the US segment of IVI-RMA Global, the largest assisted reproduction group in the world. RMA’s US business includes 28 fertility centers in New Jersey, Pennsylvania, Florida, Texas, California, Colorado, and Washington.[123]

KKR’s expansion of IVI-RMA Global comes as the fertility market is growing quickly. Market research estimates the fertility clinic market was an estimated $7.9 billion in 2022 and is forecast to grow at a rate of 13.6% annually to reach $16.8 billion by the end of 2028.[124] Private equity firms are capitalizing on this growing and lucrative industry, which remains relatively fragmented and offers opportunities to profit through consolidation.[125]

According to a 2020 study published in JAMA Internal Medicine, the years 2010 to 2016 saw very little PE investment in women’s health and fertility clinics “followed by a rapid influx of private equity activity in both OB-GYN and fertility clinics, with more than twice as many affiliations from 2017 through 2019 as seen as the previous seven years.”[126]

In a follow up study published in October 2021, the authors studied the influence of private equity in fertility treatment using data reported by the Centers for Disease Control and Prevention (CDC) on the rate of Assisted Reproductive Technology (ART) cycles. ART includes all fertility treatments in which either eggs or embryos are handled. The authors found that private equity-owned providers made up 29.3% of the of all ART cycles performed in the US in 2018, and noted that they were not aware of any healthcare specialty with such a pronounced market share.[127]

In addition, patients at PE-owned clinics were found to be 10.6% more likely to use preimplantation genetic testing, which raises questions about whether these clinics more actively push elective and costly add-ons. PE-affiliated practices also tended to be in wealthier geographic areas,[128] raising additional questions about PE’s role in exacerbating class discrepancies in access to fertility services.

These concerns are heightened by the fact that regulation of the fertility industry is fragmented. The CDC tracks ART cycles, the FDA oversees devices and drugs used in fertility treatments, and states oversee physician medial licenses – but there is no central regulatory body with oversight over fertility centers.[129]

Conclusion & Policy Recommendations

Despite the slowdown in private equity dealmaking in 2023, many private equity firms continued to invest in healthcare albeit at a slower pace and with overall less deal value than previous years.

Private equity’s growing presence in the health sector and propensity for consolidation of healthcare services is cause for concern. The common private equity strategy of pursuing outsized returns over relatively short periods of time (e.g., over a period of 3-7 years) can lead to cost-cutting efforts that negatively impact patients and workers. Further, private equity firms often use debt to fund their investments.

In the past couple of years, private equity’s use of debt to fund its healthcare investments has become a major liability as interest rates have risen.[130] In December 2022, Moody’s Investors Service found that of the 193 North American healthcare companies that it rates, 34 faced rating downgrades and potential defaults. Of those 34 companies, 30 (88%) were owned or controlled by private equity firms.[131]

High debt burdens can make it difficult for companies to dynamically respond to a changing regulatory landscape and volatile market conditions while meeting their debt service obligations. The impacts of debt go beyond the financial viability of the company in question; debt service obligations can also lead to cost-cutting that negatively impacts healthcare workers and patient care.

In February 2023, Bloomberg published an article detailing how the healthcare industry has transformed under increased private equity investment, arguing: “Healthcare companies used to be some of the safest to lend to during economic downturns, until private equity firms bought them out and larded them with debt. Now they’re some of the riskiest borrowers in the world of leveraged loans.”[132]

Major private equity-owned healthcare companies that declared bankruptcy in 2023 include Envision Healthcare, GenesisCare, Air Methods, and American Physician Partners.

Meanwhile, many private equity investors argue that that their investments can improve healthcare.[133] So far, research has demonstrated that any efficiencies achieved through consolidation and scaling up are not leading to reduced healthcare costs or improved quality of care.[134] In fact, quality of care and healthcare costs can worsen after private equity takeovers.[135][136]

The Private Equity Stakeholder Project has reported on the negative impacts of private equity in healthcare, including on durable medical equipment, rural health, rural hospitals, prison healthcare, home health and hospice, travel nursing, dental care, safety net hospitals, surprise billing, and more.

In light of continued investor interest in healthcare and the risks associated with private equity ownership of healthcare companies, regulators and lawmakers should scrutinize private equity acquisitions of healthcare companies more closely and pass and implement commonsense policies to ensure access to affordable and quality healthcare for all patients in the US.

Policy Recommendations

The Federal Trade Commission (FTC) and Department of Justice (DOJ) share jurisdiction over merger and acquisition review. Transactions are assigned to one agency for review depending on which one has more expertise with the industry involved. The Hart-Scott-Rodino Act (1976) created minimum dollar thresholds ($111.4 million in 2023), above which all transactions must be reported for pre-merger review.[137]

The Private Equity Stakeholder Project advocates for an expansion of federal pre-merger review to include all private equity-backed merger and acquisition transactions, regardless of dollar value. Any private equity-backed healthcare acquisition would require reporting to and review by DOJ and FTC under an amended Hart-Scott-Rodino. Additionally, healthcare mergers and acquisitions review authority should be expanded to the US Department of Health and Human Services, due to impacts private equity investment may have on quality of and access to patient care.

Similar measures should be taken on the state level as well. State health departments should also be given authority to review healthcare mergers for possible effects on quality or access to care. States should consider implementing multi-agency healthcare transaction approval processes for healthcare transactions. This multi-agency process should include state attorneys general, administrative agencies, and stakeholders such as patient advocates and labor organizations.

Rhode Island currently has one of the strongest set of regulations for reviewing healthcare mergers. The Rhode Island AG holds significant power to enforce the state’s Hospital Conversions Act (HCA) by intervening in healthcare mergers and acquisitions that may not meet the criteria to maintain or enhance the delivery of healthcare in the state.[138]

In fact, Rhode Island AG Peter Neronha used his office’s powers when in 2021 private equity firm Leonard Green and Partners tried to exit its investment in safety net hospital chain, Prospect Medical Holdings, after extracting hundreds of millions of dollars in debt-funded dividends.[139] As a condition of the sale, Neronha proposed that Leonard Green and the minority owners commit $120 million to an escrow account to ensure the hospital stay open. In response, Prospect threatened to shut down the Rhode Island hospitals.[140]

After weeks of negotiations with the state, the Leonard Green-led ownership group eventually agreed to commit $80 million into an escrow account to ensure that the company’s two Rhode Island hospitals remain open.[141]

California, Illinois, Minnesota, Washington, New York, and Oregon, have also recently passed legislation or changed rules to increase state oversight of healthcare transactions that may have anticompetitive impacts, while Pennsylvania is in the process of attempting to update their regulations. While these new state laws vary considerably,[142] they point to a trend that more is needed in the regulation of healthcare mergers and acquisitions.

Having robust regulations on the books is not enough. All relevant regulatory agencies at the state and federal levels must be adequately funded to ensure they can carry out their enforcement duties.

Finally, relevant federal agencies should expand funding for research examining the impacts of private equity healthcare acquisitions on several measures, including cost, quality of care, and access to care. Such research can help inform patient-centered legislation and policies that ensure access to affordable and quality healthcare for all patients in the US.

2023 Monthly Acquisitions Blog Posts

For more information about last year’s private equity acquisitions in healthcare, check out our 2023 monthly acquisitions blog posts:

Appendices

Appendix A

Methodology

Each month, the healthcare team at PESP uses PitchBook to identify private equity-backed buyouts, add-on acquisitions and growth investments in the United States healthcare sector. A list of deals is generated, and then each reported deal is reviewed to verify accuracy and relevancy. The companies involved in the deals are then classified using categories tailored to PESP’s strategic research needs. The PitchBook data is verified and supplemented with news and internet searches. After the year end, a deals search is run for the whole year to identify deals that may have been missed during our initial monthly searches due to the timing of news releases. Using this methodology, we identified 148 buyouts, 728 add-on acquisitions, and 260 growth investments for 2024, for a total of 1136 unique deals.

Limitations

It is possible some deals were missed due to our methodology, and therefore the data for this report should be read as an approximation of the private equity activity happening in the US health sector. Further, tracking private equity deal activity relies on firms accurately self-reporting their acquisitions and investments. It is possible some deals were missed or classified under the wrong month due to incomplete information from the parties involved in the transactions.

The classification scheme for healthcare companies was designed by PESP; note that some companies do not fall neatly into one category. Sometimes, a company is assigned two categories, or a single category is chosen to best represent the company type. There is some subjectivity involved in the classification system and so the data may not align perfectly with similar datasets using different classification schemes.

Changes from our Recent Trends in Private Equity Healthcare Acquisitions report covering 2022’s acquisitions

Between our 2022 report and our 2023 report we modified 1) the methodology used for identifying deals and 2) the classification scheme for healthcare companies. As such, our data is not easily comparable to 2022’s data. Our 2022 data was an underestimate of deals because we did not do an end-of-year sweep to identify deals that may have been announced later than when we ran our initially monthly searches. We also did not track growth investments for the 2022 report. Lastly, we have made some changes to our classification scheme and so some categories cannot easily be compared to the previous year. For example, we have separated out dental care and physical therapy from outpatient care into their own categories.

For questions about the report data, methodology, and limitations, please contact Mary Bugbee at [email protected].

Appendix B: List of 2023 Buyouts

Click here to see the full list of 2023 healthcare buyouts.

Appendix C: List of 2023 Add-on Acquisition

Click here to see the full list of 2023 add-on acquisitions.

Appendix D: List of 2023 Growth Investments

Click here to see the full list of 2023 growth investments.

[1] While “deals” can refer to a variety of deal types, we will use “deals” to refer to buyouts, growth investments, and add-on acquisitions.

[2] Lavoie, Bob, Jaclyn Cole, Supriya Jain, Ramakrishnan, and Alistair Leonard. “The 2024 Outlook for Private Equity in US Health Care.” BCG Global, December 20, 2023. https://www.bcg.com/publications/2024/private-equity-in-health-care-2024.

[3] Lavoie, Bob, Jaclyn Cole, Supriya Jain, Ramakrishnan, and Alistair Leonard. “The 2024 Outlook for Private Equity in US Health Care.” BCG Global, December 20, 2023. https://www.bcg.com/publications/2024/private-equity-in-health-care-2024.

[4] McNeely, Allison, Dawn Lim, and Layan Odeh. “Private Equity’s Horrible, No-Good ’23 Set to Continue Into ’24.” Bloomberg.Com, January 8, 2024. https://www.bloomberg.com/news/articles/2024-01-08/private-equity-braces-for-tough-2024-as-interest-rates-stay-high.

[5] Cooper, Laura, and Ben Dummett. “‘This Can’t Go On for Much Longer.’ Private Equity’s Deal Lament.” WSJ, December 31, 2023, sec. Markets. https://www.wsj.com/finance/investing/this-cant-go-on-for-much-longer-private-equitys-deal-lament-493a4bbb.

[6] Regal Healthcare Partners. “Regal Healthcare Capital Partners Announces Formation of InFocus Eyecare,” June 9, 2022. https://www.prnewswire.com/news-releases/regal-healthcare-capital-partners-announces-formation-of-infocus-eyecare-301563136.html.

[7] Infocus Eyecare. “Locations.” Accessed February 11, 2024. https://www.infocuseyecare.com/pages/location.

[8] Wallace, Claire. “Unifeye Vision Partners: An Acquisition Timeline.” Becker’s ASC Review, March 6, 2023. https://www.beckersasc.com/ophthalmology/unifeye-vision-partners-an-acquisition-timeline.html.

[9] Wallace, Claire. “Unifeye Vision Partners: An Acquisition Timeline.” Becker’s ASC Review, March 6, 2023. https://www.beckersasc.com/ophthalmology/unifeye-vision-partners-an-acquisition-timeline.html.

[10] Unifeye Vision Partners. “Our Partners | Vision Partnerships.” Accessed February 11, 2024. https://www.uvpeye.com/our-partners/.

[11] “Private Equity Investmeny in Vision Care: Creating a Comprehensive Provider,” p. 2. Provident Healthcare Partners, March 2020. https://www.providenthp.com/wp-content/uploads/2020/03/Private-Equity-Investment-in-Vision-Care.pdf.

[12] Yashaswini Singh et al., “Association of Private Equity Acquisition of Physician Practices With Changes in Health Care Spending and Utilization,” JAMA Health Forum 3, no. 9 (September 2, 2022): e222886, https://doi.org/10.1001/jamahealthforum.2022.2886.

[13] Weber, Lauren. “Private Equity Sees the Billions in Eye Care as Firms Target High-Profit Procedures.” Kaiser Health News, September 19, 2022. https://khn.org/news/article/private-equity-ophthalmology-eye-care-high-profit-procedures/.

[14] Hatton, Riz. “Why United Digestive Swapped Private Equity Partners and What’s Next.” Becker’s GI & Endoscopy, April 4, 2023. https://www.beckersasc.com/gastroenterology-and-endoscopy/why-united-digestive-swapped-private-equity-partners-and-whats-next.html.

[15] Hatton, Riz. “Why United Digestive Swapped Private Equity Partners and What’s Next.” Becker’s GI & Endoscopy, April 4, 2023. https://www.beckersasc.com/gastroenterology-and-endoscopy/why-united-digestive-swapped-private-equity-partners-and-whats-next.html.

[16] Physician Growth Partners. “Gastroenterology Private Equity | White Paper Fall 2021 | PGP,” Fall 2021. https://www.physiciangrowthpartners.com/white-paper/gastroenterology-private-equity-fall-2021/.

[17] Kincaid, Ginny. “45 Is the New 50 for Colorectal Cancer Screening | Blogs | CDC,” June 8, 2021. https://blogs.cdc.gov/cancer/2021/06/08/45-is-the-new-50-for-colorectal-cancer-screening/.

[18] Sinicrope, Frank A. “Increasing Incidence of Early-Onset Colorectal Cancer.” Edited by Dan L. Longo. New England Journal of Medicine 386, no. 16 (April 21, 2022): 1547–58. https://doi.org/10.1056/NEJMra2200869.

[19] Pg. 5, “National and Regional Projections of Supply and Demand for Internal Medicine Subspeciality Practitioners: 2013-2025.” U.S. Department of Health and Human Services, Health Resources and Services Administration, Bureau of Health Workforce, National Center for Health Workforce Analysis, December 2016. https://bhw.hrsa.gov/sites/default/files/bureau-health-workforce/data-research/internal-medicine-subspecialty-report.pdf.

[20] Kickirillo, Vincent M., Savanna Dinkel, and Landon Miner. “Gastroenterology: An Emerging Trend in Private Equity Healthcare Transactions.” Becker’s ASC, September 4, 2019. https://www.beckersasc.com/asc-transactions-and-valuation-issues/gastroenterology-an-emerging-trend-in-private-equity-healthcare-transactions.html.

[21] Cardiovascular Associates of America. “CVAUSA Partner Practices.” Accessed February 23, 2024. https://cvausa.com/our-cardiovascular-partners.

[22] Fenne, Michael. “Private Equity Health Care Acquisitions – April 2023.” Private Equity Stakeholder Project (blog), May 22, 2023. https://pestakeholder.org/news/private-equity-health-care-acquisitions-april-2023/. ; “Private Equity and Cardiology at ASCs.” Accessed July 21, 2023. https://www.beckershospitalreview.com/podcasts/becker-s-cardiology-podcast/private-equity-and-cardiology-at-ascs-96714260.html; Epstein Becker & Green, P.C. “On-Demand Webinar: The Rise of Private Equity Partnerships with Cardiology Groups: What’s Going On and Why?,” November 9, 2022. https://www.ebglaw.com/insights/the-rise-of-private-equity-partnerships-with-cardiology-groups-whats-going-on-and-why/; Strode, Roger. “Cardiology: The New Darling of Private Equity Investment | Foley & Lardner LLP.” Healthcare Law Today (blog), February 6, 2023. https://www.foley.com/en/insights/publications/2023/02/cardiology-new-darling-private-equity-investment; Lou, Nichole. “Private Equity Has New Love for Cardiology. Should Doctors Take the Deal?” MedPage Today, February 16, 2023. https://www.medpagetoday.com/special-reports/exclusives/103144; Springer, Rebecca. “PE Finds a New Healthcare Play in Cardiology | PitchBook.” News & Analysis (blog), May 13, 2023. https://pitchbook.com/newsletter/pe-finds-a-new-healthcare-play-in-cardiology-Ftr.

[23] Centers for Disease Control and Prevention. “Heart Disease Facts | Cdc.Gov,” October 14, 2022. https://www.cdc.gov/heartdisease/facts.htm.

[24] Strode, Roger. “Cardiology: The New Darling of Private Equity Investment | Foley & Lardner LLP.” Healthcare Law Today (blog), February 6, 2023. https://www.foley.com/en/insights/publications/2023/02/cardiology-new-darling-private-equity-investment.

[25] Chartis. “What the Acquisition of OneOncology Means for Oncology Providers and Investors,” May 18, 2023. https://www.chartis.com/insights/what-acquisition-oneoncology-means-oncology-providers-and-investors.

[26] Cencora. “TPG and AmerisourceBergen Announce Completion of Acquisition of OneOncology,” June 9, 2023. https://investor.cencora.com/news/news-details/2023/TPG-and-AmerisourceBergen-Announce-Completion-of-Acquisition-of-OneOncology/default.aspx.

[27] Armental, Maria, and Colin Kellaher. “General Atlantic Exits Cancer-Care Investment.” Wall Street Journal, April 21, 2023, sec. WSJ Pro. https://www.wsj.com/articles/general-atlantic-exits-cancer-care-investment-91d37722.

[28] Chartis. “What the Acquisition of OneOncology Means for Oncology Providers and Investors,” May 18, 2023. https://www.chartis.com/insights/what-acquisition-oneoncology-means-oncology-providers-and-investors.

[29] OneOncology, “OneOncology Inks Partnership with Two Independent Practices,” PR Newswire, May 3, 2023, https://www.prnewswire.com/news-releases/oneoncology-inks-partnership-with-two-independent-practices-301813945.html.

[30] Hoffman, Eric. “OneOncology Partners with Mid Florida Cancer Centers.” OneOncology (blog), November 8, 2023. https://www.oneoncology.com/blog/oneoncology-partners-with-mid-florida-cancer-centers.

[31] Kevin Tyan, Miranda B. Lam, and Michael Milligan, “Private Equity Acquisition of Oncology Clinics in the US From 2003 to 2022,” JAMA Internal Medicine, May 1, 2023, https://doi.org/10.1001/jamainternmed.2023.0334.

[32] Kevin Tyan, Miranda B. Lam, and Michael Milligan, “Private Equity Acquisition of Oncology Clinics in the US From 2003 to 2022,” JAMA Internal Medicine, May 1, 2023, https://doi.org/10.1001/jamainternmed.2023.0334.

[33] Francis J. Crosson, Isabel R. Ostrer, and Cary P. Gross, “Private Equity in US Health Care—Now Cradle to Grave?,” JAMA Internal Medicine, May 1, 2023, https://doi.org/10.1001/jamainternmed.2023.0324.

[34] Victoria Bailey, “Private Equity Firms Acquired Over 700 Oncology Practices in 20 Years,” RevCycleIntelligence, May 3, 2023, https://revcycleintelligence.com/news/private-equity-firms-acquired-over-700-oncology-practices-in-20-years.

[35] Dave Sebastian, “KKR-Backed Radiotherapy Group GenesisCare Files for Bankruptcy,” Wall Street Journal, June 1, 2023, https://www.wsj.com/livecoverage/stock-market-today-dow-jones-06-01-2023/card/kkr-backed-radiotherapy-group-genesiscare-files-for-bankruptcy-LIVUzBoTLS8Z2Z8qPcP9.

[36] O’Grady, Eileen. “Deceptive Marketing, Medicaid Fraud, and Unnecessary Root Canals on Babies: Private Equity Drills into the Dental Care Industry.” Private Equity Stakeholder Project, July 2021. https://pestakeholder.org/wp-content/uploads/2021/08/PESP_DSO_July2021.pdf.

[37] O’Grady, Eileen. “Deceptive Marketing, Medicaid Fraud, and Unnecessary Root Canals on Babies: Private Equity Drills into the Dental Care Industry.” Private Equity Stakeholder Project, July 2021. https://pestakeholder.org/wp-content/uploads/2021/08/PESP_DSO_July2021.pdf.

[38] O’Grady, Eileen. “Deceptive Marketing, Medicaid Fraud, and Unnecessary Root Canals on Babies: Private Equity Drills into the Dental Care Industry.” Private Equity Stakeholder Project, July 2021. https://pestakeholder.org/wp-content/uploads/2021/08/PESP_DSO_July2021.pdf.

[39] Caitlin Owens. “Private Equity’s Pandemic-Era Health Care Push.” Axios, March 23, 2022. https://www.axios.com/2022/03/23/pharmaceuticals-private-equity-medical-devices-drug-prices.

[40] American Investment Council. “Improving Medical Technologies: Private Equity’s Role Supporting Life Sciences,” March 22, 2022. https://www.investmentcouncil.org/improving-medical-technologies-private-equitys-role-supporting-life-sciences/.

[41] Burlingame, Laurie. “Medtech and Diagnostics Market: 2023 Trends and 2024 Outlook,” January 25, 2024. https://www.morganlewis.com/pubs/2024/01/medtech-and-diagnostics-market-2023-trends-and-2024-outlook.

[42] Cairns, Elizabeth. “Medtech Dealmaking Grinds Almost to a Halt.” Evaluate.Com (blog), July 5, 2023. https://www.evaluate.com/vantage/articles/insights/ma/medtech-dealmaking-grinds-almost-halt.

[43] Cairns, Elizabeth. “Medtech Dealmaking Grinds Almost to a Halt.” Evaluate.Com (blog), July 5, 2023. https://www.evaluate.com/vantage/articles/insights/ma/medtech-dealmaking-grinds-almost-halt.

[44] John McNulty. “Carlyle’s Acrotec Acquires Family-Owned Axial Medical.” Private Equity Professional, February 13, 2023. https://peprofessional.com/blog/2023/02/13/carlyles-acrotec-acquires-family-owned-axial-medical/.

[45] Carlyle. “Resonetics to Acquire SAES Medical Nitinol Business | Carlyle,” January 9, 2023. https://www.carlyle.com/media-room/news-release-archive/resonetics-to-acquire-saes-medical-nitinol-business.

[46] “Home Care Delivered, Inc. Completes Acquisition of Medline Industries, LP’s DMEPOS Supplier Business Unit,” BPOC, October 16, 2023/ https://www.bpoc.com/news/Home-Care-Delivered-Inc-Completes-Acquisition-of-Medline-Industries-LPs-DMEPOS-Supplier-Business-Unit

[47] “Home Care Delivered, Inc. Completes Acquisition of Medline Industries, LP’s DMEPOS Supplier Business Unit,” BPOC, October 16, 2023/ https://www.bpoc.com/news/Home-Care-Delivered-Inc-Completes-Acquisition-of-Medline-Industries-LPs-DMEPOS-Supplier-Business-Unit

[48]https://www.nordiccapital.com/news-views/press-releases/nordic-capital-backed-sunrise-medical-completes-strategic-acquisition-of-ride-designs/

[49] Eileen O’Grady, “Private Equity in DME: How Private Equity Profits Off of Disabled and Chronically Ill Americans,” November 2023. https://pestakeholder.org/news/private-equity-stranglehold-on-medical-equipment-industry-hurts-people-with-disabilities/

[50] Rossi, Sergio, Christine Barton, and Andrea Agnolio. “Medical Aesthetics Is Resilient, Growing, and Attracting Investors.” BCG Global, May 8, 2023. https://www.bcg.com/publications/2023/medical-aesthetics-industry-growth-attracting-investors.

[51] Rossi, Sergio, Christine Barton, and Andrea Agnolio. “Medical Aesthetics Is Resilient, Growing, and Attracting Investors.” BCG Global, May 8, 2023. https://www.bcg.com/publications/2023/medical-aesthetics-industry-growth-attracting-investors.

[52] “PitchBook Profile – Advanced MedAesthetic Partners.” Accessed February 8, 2024. https://my.pitchbook.com/profile/512142-22/company/profile#general-info; Leon Capital. “Our History.” Accessed February 16, 2024. https://www.leoncapitalgroup.com/our-history/.

[53] Leon Capital. “Advanced MedAesthetic Partners.” Accessed February 8, 2024. https://www.leoncapitalgroup.com/advanced-medaesthetic-partners/.

[54] ARC Health. “Exult Healthcare Joins ARC Health.” Accessed February 12, 2024. https://www.prnewswire.com/news-releases/exult-healthcare-joins-arc-health-302023831.html.

[55] ARC Health. “Advanced Psychiatric Group Joins ARC Health,” December 4, 2023. https://www.prnewswire.com/news-releases/advanced-psychiatric-group-joins-arc-health-302004849.html.

[56] Lovett, Laura. “PE-Backed ARC Health Acquires Manhattan Psychology Group.” Behavioral Health Business, November 28, 2023. https://bhbusiness.com/2023/11/28/pe-backed-arc-health-acquires-manhattan-psychology-group/.

[57] ARC Health. “GROW Counseling Joins ARC Health,” November 3, 2023. https://www.prnewswire.com/news-releases/grow-counseling-joins-arc-health-301976423.html.

[58] Lovett, Laura. “Thurston-Backed ARC Health Picks Up Pediatric-Focused Dayspring Behavioral Health.” Behavioral Health Business, August 17, 2023. https://bhbusiness.com/2023/08/17/thurston-backed-arc-health-picks-up-pediatric-focused-dayspring-behavioral-health/.

[59] Larson, Chris. “ARC Health’s Acquisition of Silver Lake Psychology Marks Shift to Larger Mental Health Practices.” Behavioral Health Business, May 16, 2023. https://bhbusiness.com/2023/05/16/arc-healths-acquisition-of-silver-lake-psychology-marks-shift-to-larger-mental-health-practices/.

[60] Larson, Chris. “ARC Health’s Acquisition of Silver Lake Psychology Marks Shift to Larger Mental Health Practices.” Behavioral Health Business, May 16, 2023. https://bhbusiness.com/2023/05/16/arc-healths-acquisition-of-silver-lake-psychology-marks-shift-to-larger-mental-health-practices/.

[61] Larson, Chris. “ARC Health Expands to California with 4th Acquisition of 2023.” Behavioral Health Business, May 8, 2023. https://bhbusiness.com/2023/05/08/arc-health-expands-to-california-with-fourth-acquisition-of-2023/.

[62] Larson, Chris. “ARC Health Continues M&A Blitz With Wellington Counseling Group Acquisition.” Behavioral Health Business, March 28, 2023. https://bhbusiness.com/2023/03/28/arc-health-continues-ma-blitz-with-wellington-counseling-group-acquisition/.

[63] Larson, Chris. “ARC Health Closes 2023 With 18th Merger.” Behavioral Health Business, January 2, 2024. https://bhbusiness.com/2024/01/02/arc-health-closes-2023-with-18th-merger/.

[64] ARC Health. “ARC Health: A Year in Reflection,” January 17, 2024. https://www.prnewswire.com/news-releases/arc-health-a-year-in-reflection-302037646.html.

[65] “Health Connect America, Inc. Acquires First Home Care and North Star Counseling of Central Florida,” February 22, 2023. https://www.prnewswire.com/news-releases/health-connect-america-inc-acquires-first-home-care-and-north-star-counseling-of-central-florida-301752347.html.

[66] “HEALTH CONNECT AMERICA ACQUIRES SPECIALIZED YOUTH SERVICES OF VIRGINIA, INC.,” August 3, 2023. https://www.prnewswire.com/news-releases/health-connect-america-acquires-specialized-youth-services-of-virginia-inc-301892509.html.

[67] Palladium Equity Partners, “Health Connect America, Inc. Acquires First Home Care and North Star Counseling of Central Florida,” press release, February 22nd, 2023. https://www.palladiumequity.com/2023/02/22/health-connect-america-inc-acquires-first-home-care-and-north-star-counseling-of-central-florida/.

[68] “HEALTH CONNECT AMERICA ACQUIRES SPECIALIZED YOUTH SERVICES OF VIRGINIA, INC.,” August 3, 2023. https://www.prnewswire.com/news-releases/health-connect-america-acquires-specialized-youth-services-of-virginia-inc-301892509.html.

[69] Health Connect America, https://www.healthconnectamerica.com/. Accessed February 12, 2024.

[70] Laura Lovett, “Palladium Equity-Backed Health Connect America Makes 5th Acquisition in 18 Months,” Behavioral Health Business, February 22, 2023, https://bhbusiness.com/2023/02/22/palladium-equity-backed-health-connect-america-makes-5th-acquisition-in-18-months/.

[71] Palladium Equity Partners, “Palladium Equity Partners, L.L.C. Acquires ALC Schools, LLC and Red Rock Technology, LLC,” press release, March 2, 2020. https://www.prnewswire.com/news-releases/palladium-equity-partners-llc-acquires-alc-schools-llc-and-red-rock-technology-llc-301013782.html.

[72] EverDriven, “EverDriven Aims to Meet Surge in Alternative Transportation Demand,” press release, August 5, 2022. https://www.schoolbusfleet.com/10178516/everdriven-aims-to-meet-surge-in-alternative-transportation-demand.

[73] Eileen O’Grady, “The Kids Are Not Alright: How Private Equity Profits Off of Behavioral Health Services for Vulnerable and At-Risk Youth,” Private Equity Stakeholder Project, January 2022. https://pestakeholder.org/reports/the-kids-are-not-alright-how-private-equity-profits-off-of-behavioral-health-services-for-vulnerable-and-at-risk-youth/

[74] Eileen O’Grady, “The Kids Are Not Alright: How Private Equity Profits Off of Behavioral Health Services for Vulnerable and At-Risk Youth,” Private Equity Stakeholder Project, January 2022. https://pestakeholder.org/reports/the-kids-are-not-alright-how-private-equity-profits-off-of-behavioral-health-services-for-vulnerable-and-at-risk-youth/

[75] Eileen O’Grady. “The Kids Are Not Alright: How Private Equity Profits Off of Behavioral Health Services for Vulnerable and At-Risk Youth.” Private Equity Stakeholder Project PESP, February 17, 2022. https://pestakeholder.org/news/the-kids-are-not-alright-how-private-equity-profits-off-of-behavioral-health-services-for-vulnerable-and-at-risk-youth/.

[76] Bannow, Tara. “The Private Equity Firms, like Blackstone and KKR, behind 8 of the Biggest Names in Autism Therapy.” STAT, August 15, 2022. https://www.statnews.com/2022/08/15/private-equity-autism-therapy-major-names/.

[77] Bannow, Tara. “Parents and Clinicians Say Private Equity’s Profit Fixation Is Short-Changing Kids with Autism.” STAT, August 15, 2022. https://www.statnews.com/2022/08/15/private-equity-autism-aba-therapy/.

[78] Chris Larson. “KKR-Backed BlueSprig Rolls Up Trumpet Behavioral Health, Adds Nearly 40 Locations to Footprint.” Behavioral Health Business, October 18, 2023. https://bhbusiness.com/2023/10/18/kkr-backed-bluesprig-rolls-up-trumpet-behavioral-health-adds-nearly-40-locations-to-footprint/.

[79] Eileen O’Grady, “PE’s failed autism failed bets harm workers and consumers,” Private Equity Stakeholder Project, July 28, 2023. https://pestakeholder.org/news/pes-failed-autism-failed-bets-harm-workers-and-consumers/

[80] Headlands Research. “Headlands Research Acquires Established Eastern Massachusetts–Based Research Site Specializing in Neurodegenerative Diseases,” April 18, 2023. https://headlandsresearch.com/news/headlands-research-acquires-established-eastern-massachusetts-based-research-site-specializing-in-neurodegenerative-diseases/.

[81] “Headlands Research Acquires Clinvest Research — the Clinical Research Site Network’s Third Addition of 2023,” May 4, 2023. https://www.businesswire.com/news/home/20230504005315/en/Headlands-Research-Acquires-Clinvest-Research-%E2%80%94-the-Clinical-Research-Site-Network%E2%80%99s-Third-Addition-of-2023.

[82] “Headlands Research Acquires AMCR Institute, Adding Medical Device Expertise to the Clinical Research Site Network.” Headlands Research (blog), July 27, 2023. https://headlandsresearch.com/news/headlands-research-acquires-amcr-institute-adding-medical-device-expertise-to-the-clinical-research-site-network/.

[83] Clinical Research News Online. “Headlands Research Continues Accelerated Growth with the Acquisition of Clinical Research Professionals, Further Expanding Its Geographic Reach,” October 11, 2023. https://www.clinicalresearchnewsonline.com/news/2023/10/16/headlands-research-continues-accelerated-growth-with-the-acquisition-of-clinical-research-professionals-further-expanding-its-geographic-reach.

[84] Ron Leuty. “KKR-Backed Startup Headlands Research on Hunt to Buy Clinical Trial Sites.” San Francisco Business Times, November 13, 2019. https://headlandsresearch.com/wp-content/uploads/SFBT-11.13.19.pdf.

[85] Headlands Research. “Headlands Sites.” Accessed February 23, 2024. https://headlandsresearch.com/headlands-sites/.

[86] NMS Capital. “NMS Capital Announces Formation of Flourish Research and Investment in Clinical Trials of Texas,” August 12, 2021. https://nms-capital.com/news/nms-capital-announces-formation-of-flourish-research-and-investment-in-clinical-trials-of-texas/.

[87] NMS Capital. “NMS Capital Portfolio Company Flourish Research Announces Partnerships with AMC Research and Central Research Associates,” May 18, 2023. https://nms-capital.com/news/nms-capital-announces-formation-of-a-regional-solid-waste-hauling-platform-through-partnership-with-and-investment-in-texas-pride-disposal-solutions-and-the-texas-dumpsters-companies-2-2/.

[88] “Flourish Research Acquires Alzheimer s Memory Center | Mergr M&A Deal Summary.” Accessed February 12, 2024. https://mergr.com/flourish-research-acquires-amc-research.

[89] Flourish Research. “Flourish Research Announces the Acquisition of Valley Clinical Trials in California,” September 26, 2023. https://www.prweb.com/releases/flourish-research-announces-the-acquisition-of-valley-clinical-trials-in-california-301938045.html.

[90] Flourish Research. “Flourish Research Grows with Merritt Island Medical Research Acquisition.” Accessed February 12, 2024. https://www.prweb.com/releases/flourish-research-grows-with-merritt-island-medical-research-acquisition-302016580.html.

[91] “Locations – Flourish Research.” Accessed February 12, 2024. https://flourishresearch.com/locations/.

[92] Rachana Pradhan. “The Business of Clinical Trials Is Booming. Private Equity Has Taken Notice.” Fortune, December 2, 2022. https://fortune.com/2022/12/02/clinical-trials-private-equity-headlands-research/.

[93]Michael Patton and Dan O’Brien, “Consolidation in Clinical Research Sites and COVID’s Impact” (Provident Healthcare Partners, n.d.), https://www.providenthp.com/wp-content/uploads/2022/03/Consolidation-in-Clinical-Research-Sites-and-COVIDs-Impact-vF.pdf.

[94] Caitlin Oprysko, “Who Lobbies for Carried Interest Backers,” POLITICO, August 8, 2022, https://politi.co/3QaBVVb.

[95]“Improving Medical Technologies: Private Equity’s Role Supporting Life Sciences,” American Investment Council, March 22, 2022, https://www.investmentcouncil.org/improving-medical-technologies-private-equitys-role-supporting-life-sciences/.

[96] Patti Neighmond, “When Insurance Won’t Cover Drugs, Americans Make ‘Tough Choices’ About Their Health,” NPR, January 27, 2020, sec. Public Health, https://www.npr.org/sections/health-shots/2020/01/27/799019013/when-insurance-wont-cover-drugs-americans-make-tough-choices-about-their-health; Juliette Cubanski and Tricia Neuman, “Prices Increased Faster Than Inflation for Half of All Drugs Covered by Medicare in 2020,” KFF (blog), February 25, 2022, https://www.kff.org/medicare/issue-brief/prices-increased-faster-than-inflation-for-half-of-all-drugs-covered-by-medicare-in-2020/; RAND Corporation, “Prescription Drug Prices in the United States Are 2.56 Times Those in Other Countries,” January 28, 2021, https://www.rand.org/news/press/2021/01/28.html; Tina Reed, “Insurers Blame Specialty Drug Costs for Rising Premiums. This Report from California Shows Why,” Fierce Healthcare, January 7, 2019, https://www.fiercehealthcare.com/payer/report-prescription-drug-costs-driving-up-insurance-premiums; Sara Heath, “High Drug Prices Account for One-Quarter of Patient Insurance Costs,” PatientEngagementHIT, May 23, 2018, https://patientengagementhit.com/news/high-drug-prices-account-for-one-quarter-of-patient-insurance-costs; David Lazarus, “Column: When a Hospital Sling Costs 900% More than Amazon’s Price, Something Is Very Wrong,” Los Angeles Times, September 13, 2019, https://www.latimes.com/business/story/2019-09-12/medical-equipment-pricing; Chuck Dinerstein, “An Overlooked Health Care Cost – The Medical Device Market,” American Council on Science and Health, October 3, 2018, https://www.acsh.org/news/2018/10/03/overlooked-health-care-cost-medical-device-market-13468.