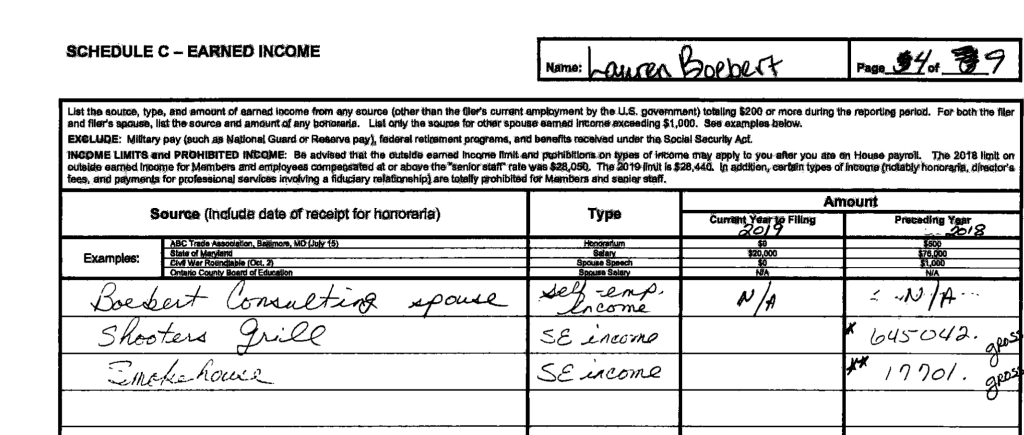

Kayne Anderson and Warburg Pincus fracking company tied to $1 million in payments to Rep. Boebert’s husband

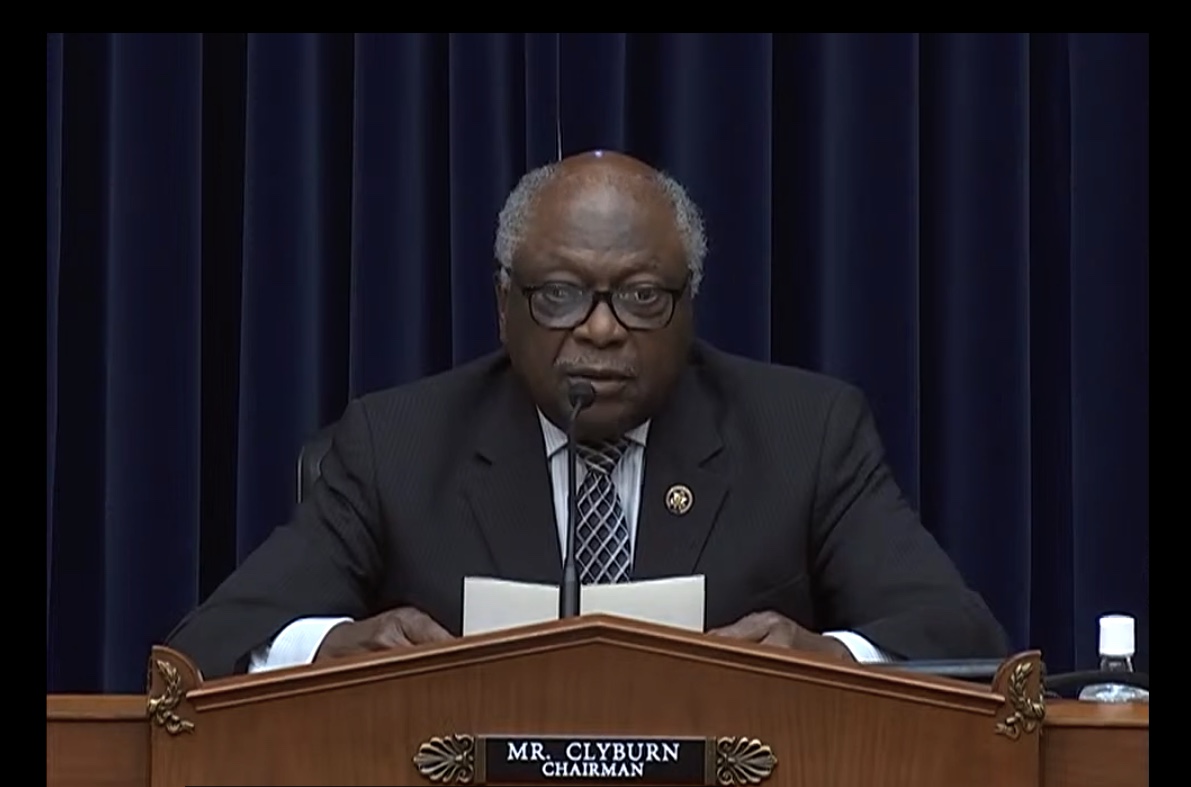

A fracking company owned by two private equity firms paid nearly $1 million in consulting fees to the spouse of Representative Lauren Boebert (CO) that she failed to disclose until last week.Terra Energy Partners, based in Texas…