Time for full transparency from Carlyle: A guide for investors

This is an ideal time for all investors to ask Carlyle to be fully transparent about its emissions and energy transition plans across its entire investment portfolio, not…

Find more information on the issues deeply affected by private equity investments:

This is an ideal time for all investors to ask Carlyle to be fully transparent about its emissions and energy transition plans across its entire investment portfolio, not…

The Washington State Investment Board is responsible for overseeing the investment portfolios of 17 retirement plans catering to public employees, teachers, school personnel, law enforcement officers, firefighters, and judges. Additionally, we are entrusted with managing investments for several other significant…

The Oregon Investment Council (OIC) is responsible for managing and distributing the investments for various State of Oregon trust funds, such as the Oregon Public Employees Retirement Fund, the Common School Fund, and the State Accident Insurance Fund. Members of…

On August 23, 2023, the Securities and Exchange Commission (SEC) adopted new rules and rule amendments to enhance the regulation of private fund advisers and update the existing compliance rule that applies to all investment advisers. The new rules and…

Multiple public pensions have capital tied up in new billion-dollar PE fossil fuel funds As climate-driven natural disasters continue to affect the United States this year, new liquid natural gas (LNG) projects are still moving forward with development. Commonwealth LNG…

This week, private equity firm KKR announced the completion of its 42% stake in Port Arthur LNG Phase 1, via Sempra Infrastructure. First announced this spring, KKR’s commitment of new funding for…

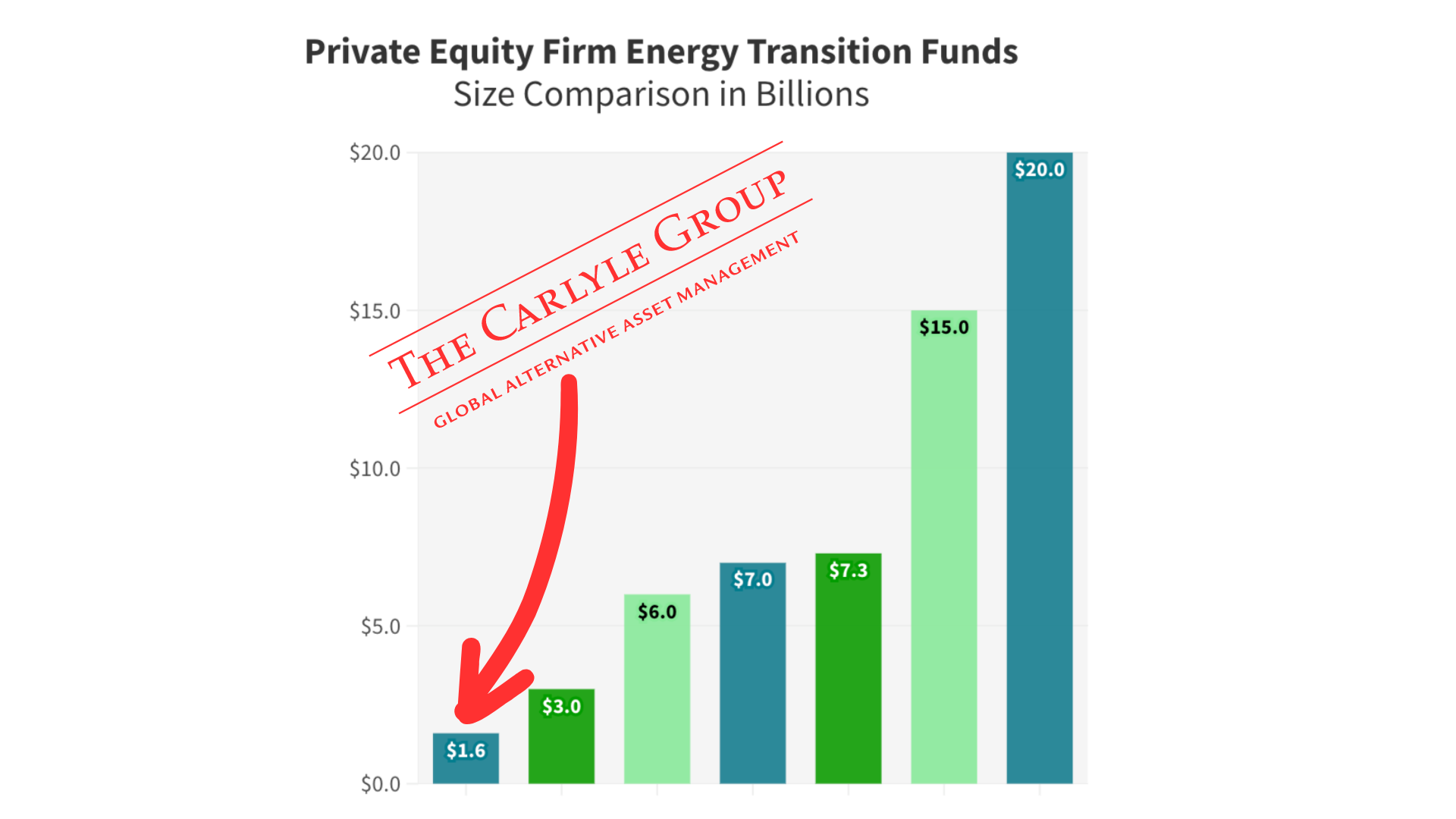

Private equity firms are seeking to portray themselves as supportive of the energy transition. One indicator of their commitment to clean energy technologies is fundraising. Several private equity firms have sought to raise money for funds with a mandate…

Deemed one of the top five drillers in the Delaware sub basin in New Mexico, Tap Rock Resources is one of the largest exploration and production platforms in private equity firm NGP Energy Capital Management’s portfolio and has…

Report Outlines KKR’s Harm to Frontline Communities As it Continues to Center a Fossil Fuel Strategy Private equity behemoth KKR’s portfolio companies have committed numerous environmental violations and engaged in unethical business practices while contributing to the climate crisis, as…

NGP Energy Capital Management (NGP or also called “Natural Gas Partners”) claims to be at the forefront of transitioning to a low-carbon economy, through “partner[ing] with first-in-class entrepreneurs building oil and gas companies that are improving their emissions intensity of…

Sustainability-focused nonprofit Ceres and the Clean Air Task Force released their annual Benchmarking Methane and Other GHG Emissions[1] report in May 2023. Of the over 300 oil and natural gas producers analyzed, 60% of the top 10…

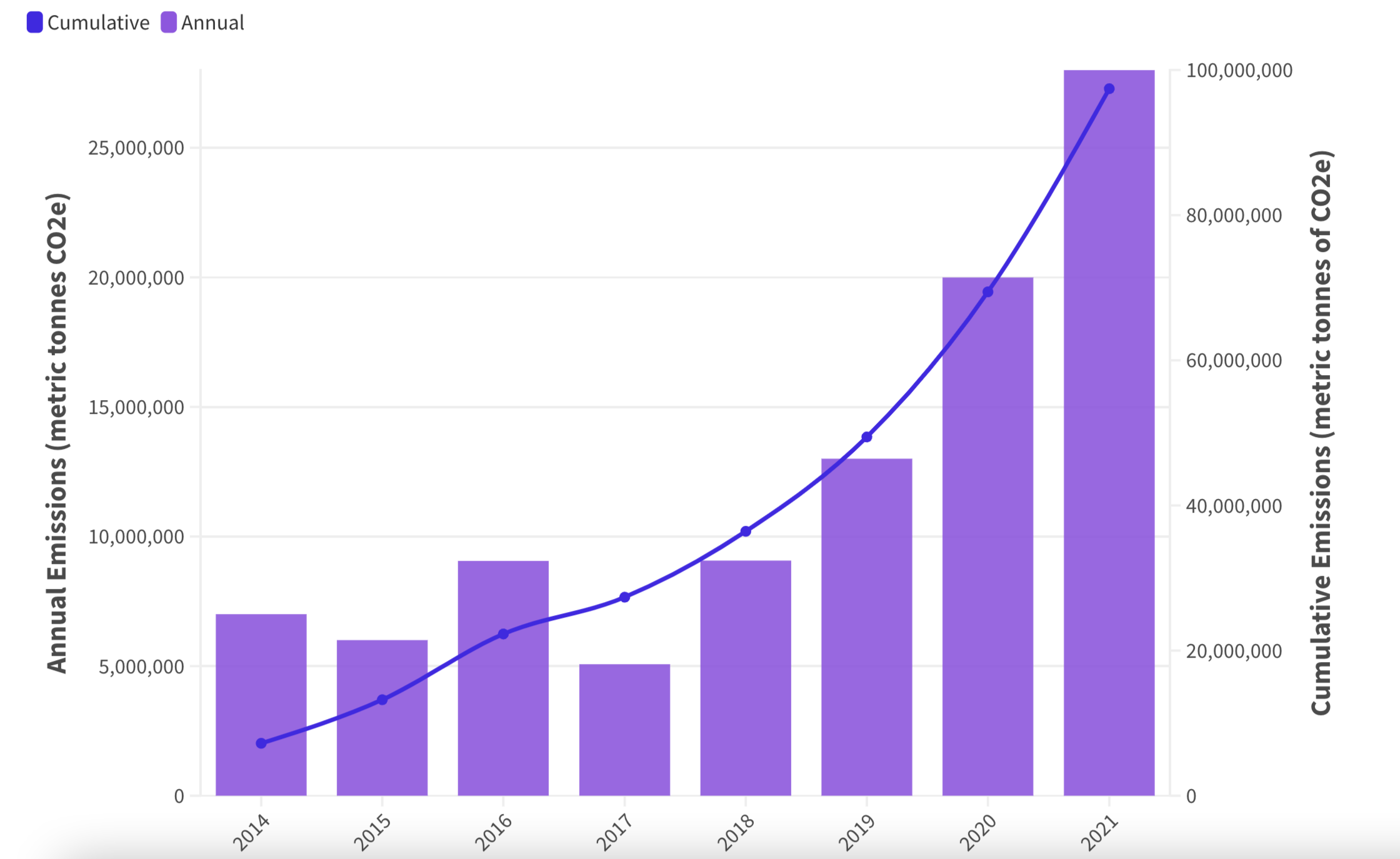

Carlyle played with the data, got lost in the ESG game In June of this year, private equity firm The Carlyle Group released their ESG report for 2023 titled the “EBITDA of ESG.”…