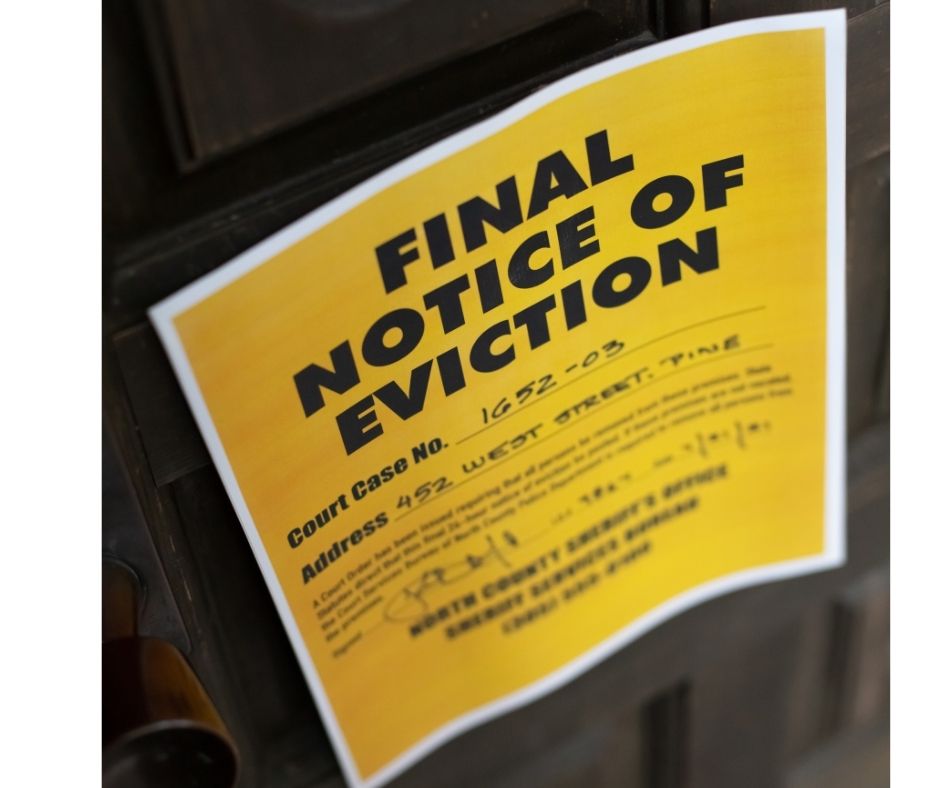

Immigrant Refresco Workers Bring Concerns to PAI Partners Investors, Demand Their Private Equity-Owned Employer Halt Anti-Union Campaign as IPO looms

Workers from the Refresco bottling plant in Wharton, NJ, have testified to four public pension boards about the funds’ investments in a union-busting company owned by private equity firm PAI Partners. In June of this year, a majority of the…