Explore the issues

Find more information on the issues deeply affected by private equity investments:

Private Equity Health Care Acquisitions – March 2022

In light of the growing investor interest in healthcare and the risks associated with private equity ownership of healthcare companies, the Private Equity Stakeholder Project will be tracking private equity-backed healthcare acquisitions. Below is a list of private equity…

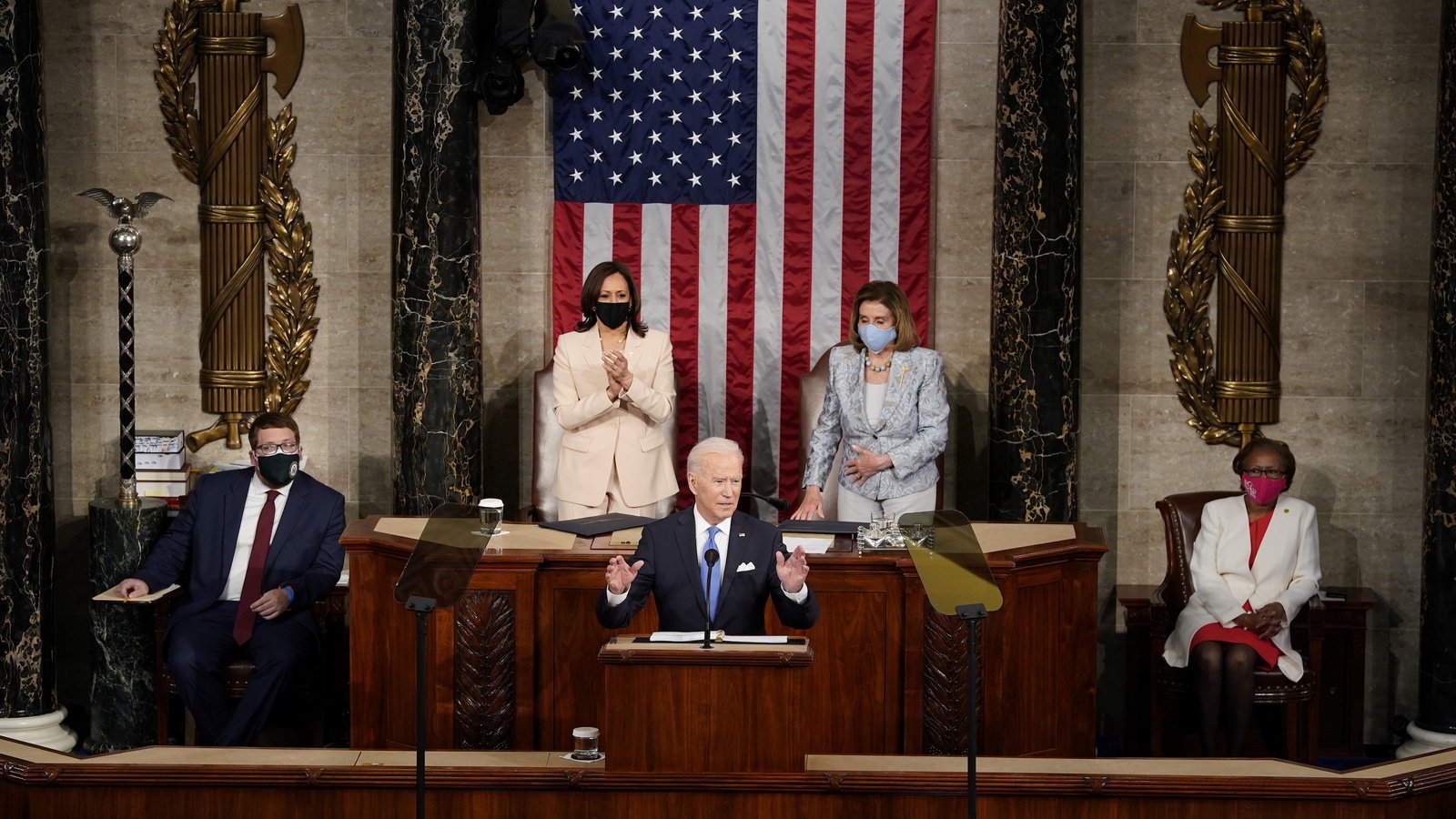

State of the Union Address Focuses on Private Equity’s Impact on Nursing Homes

On March 1, 2022, President Joe Biden gave his first State of the Union address. Included in this speech was a long section focused on private equity’s impact on patient care in nursing homes. “As Wall Street firms take over…

PESP Applauds the SEC’s Proposed Changes to Form PF, Requests Public Transparency

On January 26, the Security and Exchange Commission (SEC) voted to propose amendments to Form PF, the confidential reporting form for certain SEC-registered investment advisers to private funds. The proposed amendments are designed to enhance the Financial Stability Oversight Council’s…

Take action

Help support PESP by donating today! All donations go directly to making a difference for our research and advocacy. Financial Services Stakeholder Project NFP is a 501(c)(3) nonprofit. Your gift may qualify as a charitable deduction for federal income tax…

Private equity risks

Private equity-owned companies employ millions of workers in the United States, and the number continues to grow as private equity firms are acquiring additional companies at a record pace. The largest number of workers employed by private equity-owned companies are…

About us

The private equity industry is massive, hugely influential, and playing a role in more and more aspects of life in the US and around the world. The industry manages nearly $7.5 trillion in assets and owns companies that employ more…